Quick Overview

Aviva Life Insurance is a joint venture between Aviva Plc (UK) and the Dabur Group. The company offers a mix of term, ULIP, savings, and child plans, but its market presence is relatively modest when compared with leading private insurers in India.

Here are the key points to evaluate before choosing an Aviva life insurance policy:

- Aviva is a small-volume insurer with limited market share and higher complaint volumes.

- Claims, underwriting, and servicing may not be as seamless as those of larger insurers with in-house teams or superior digital operations.

Aviva’s products work like any standard life insurance contract. Policyholders pay a premium, and the insurer promises a payout upon death or maturity (depending on the plan type).

However, life insurance is a long-term contract. Hence, choosing a smaller insurer comes with trade-offs, which we’ll discuss later in this article.

If you're evaluating whether Aviva is the right fit, here’s a clear and practical breakdown: how Aviva Life Insurance works, the plans available, its performance metrics, and what you should know before signing a long-term contract.

Benefits of Aviva Life Insurance

Straightforward Plan Designs

Term plans and savings plans typically have fewer variants, making them easier to understand compared to complex, multi-feature policies from larger insurers.

Flexible Premium Payment Options

Premium payments can be made annually, semi-annually, or monthly, based on what’s most convenient for you.

Basic Riders Available

You can enhance coverage with add-ons such as accidental death or critical illness riders.

However, these benefits must be weighed against Aviva’s performance metrics, as mentioned below:

Performance Metrics of Aviva Life Insurance (3-year Overview)

Note: In addition to the metrics shown above, Aviva tends to score lower on product variety, customer service, and digital experience when benchmarked against larger insurers.

This is primarily due to its relatively limited product portfolio, service processes that often require additional follow-ups, and less advanced digital systems. These factors are not reflected in the table but can influence the overall customer experience.

Aviva Life Insurance Plans

Note: Aviva’s individual retail portfolio is relatively limited compared to larger private insurers. Many plans are variations of similar structures rather than entirely distinct offerings. Eligibility, age limits, payout structures, and tax benefits differ by product type and version.

For exact plan features, riders, and exclusions, readers should always review Aviva’s official product brochures.

How to Buy Aviva Life Insurance?

Aviva policies can be purchased online through the company’s website or offline via agents, brokers, or corporate partners.

The online buying journey typically involves:

- Filling in your basic personal and health details

- Comparing plan features, riders, and premiums

- Uploading KYC and financial documents

- Undergoing medical tests, if required

- Paying the premium and receiving the policy digitally

Although the process is streamlined, always compare Aviva’s offerings with other insurers to confirm the plan’s suitability and long-term support.

Estimated Annual Premiums for Aviva Term Plans

Profile: Male, non-smoker seeking a ₹2 crore term cover until the age of 70, without first-year discounts.

Note: Aviva is competitively priced at younger ages and continues to undercut HDFC Life and ICICI Prudential across age bands, while Axis Max Life remains a close competitor, especially at lower ages.

Documents Required to Buy Aviva Life Insurance

The documentation required for Aviva life insurance is largely the same as what’s needed for most standard term insurance plans. Use the infographic below as a ready checklist of the documents required for buying an Aviva policy.

Inclusions and Exclusions of Aviva Life Insurance Plans

Common Inclusions

Most Aviva life insurance plans include a standard death benefit, optional rider payouts, and maturity benefits for savings or ULIP plans.

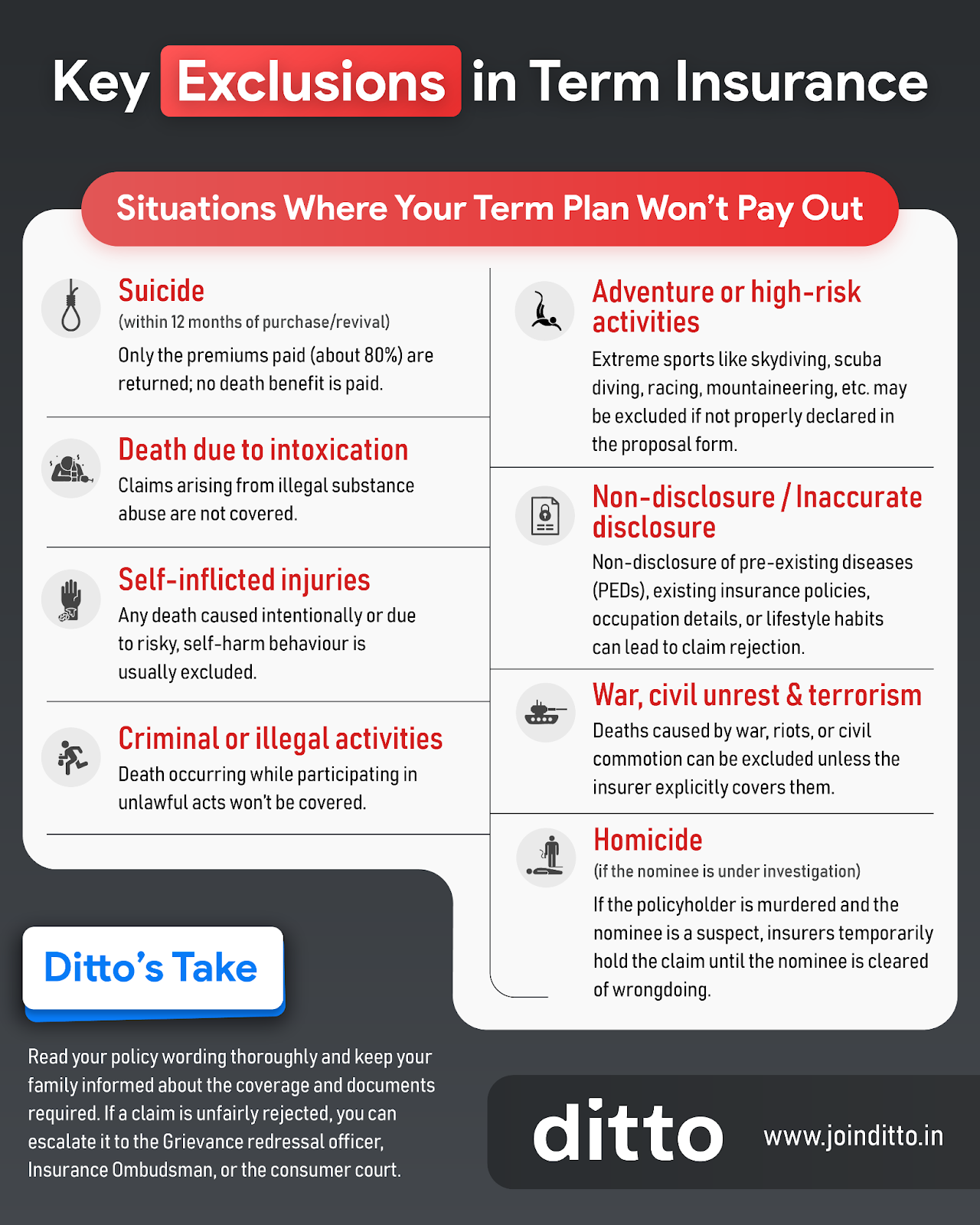

Common Exclusions

Before choosing a plan, it’s important to know the scenarios where Aviva will not honor a claim. The key exclusions are highlighted in the infographic below and are generally applicable across life insurance products.

Claim Settlement Process of Aviva Life Insurance

For a complete step-by-step guide, check here for more details. The process broadly follows the standard claim procedures used across most term insurance plans.

How Can I Check Policy Status for Aviva Life Insurance Plans?

You can track your Aviva policy status through any of the following support channels:

- Customer Portal: https://www.avivaindia.com/customer-service

- Email Support: customerservices@avivaindia.com

- Toll-Free Number: 1800-103-7766

- Branch Locator: https://www.avivaindia.com/contact-us

These channels allow you to view policy details, premium status, renewal dates, and service updates easily.

What Is the Policy Renewal Process for Aviva Life Insurance Plans?

Aviva allows multiple convenient options to renew your life insurance policy. You can make your renewal payment through:

- Aviva’s official website

- Net banking or UPI

- Mobile wallets

- Payment links shared via SMS or email

- Third-party distributor platforms

Note: A standard grace period applies as per your policy terms, so make sure to renew within the allotted timeframe to avoid a lapse in coverage. Setting up reminders or opting for auto-debit (where available) can also help avoid missed payments.

Why Talk to Ditto for Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Abhinav below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

You can book a FREE consultation here. Slots are filling up quickly, so be sure to book a call now.

Ditto’s Take on Aviva Life Insurance

Aviva’s high CSR and ASRs show that genuine claims are handled reliably. Moreover, the term plans are simple, affordable, and come with practical riders such as critical illness and waiver of premium.

However, there are certain trade-offs. Aviva’s product range is limited, and its higher complaint volume indicates that you may experience slower servicing or more follow-ups compared with larger insurers. The digital experience is also not as seamless as what many leading players now offer.

If your top priority is solid claim performance at a reasonable price, Aviva can be a good choice.

(Alternatively, you can take a look at the top insurers in India ranked by their CSR.)

However, for long-term policies where service quality and smoother support matter, it’s worth comparing Aviva with stronger, larger insurers before making a final decision.

Disclaimer

Frequently Asked Questions

Last updated on: