| What is a 3-Year Clause in Term Insurance? The 3-Year Clause in term insurance, based on Section 45 of the Insurance Act ( also called The three-year rule, Policy Contestability Period, or the Incontestability Clause), means that once a life insurance policy completes three years from the date of issuance, risk commencement, revival, or rider addition (whichever is later), it cannot be questioned or its claim cannot rejected by the insurer on any ground, except proven fraud. This gives policyholders and their families strong protection against claim denial. |

When people buy term insurance, they aim to secure their family's financial future. But what happens if a claim is denied years later due to an honest mistake, like incorrect weight or an undisclosed medical condition?

Even if these were honest mistakes, the insurer could use them to reject the claim, especially if they happen within the first 3 years of the policy.

That's why the 3-year clause exists. It brings transparency and fairness to the life insurance system in India by preventing insurance companies from rejecting claims after a specific time frame.

At Ditto, we've helped thousands of people understand term insurance better, not just the benefits, but also the fine print that often gets overlooked. In this guide, we'll walk you through the significance, exceptions, and how the 3-year rule impacts your life.

Still unsure how to make sure that the 3-year clause works in your favor? Book a free call with us and let our experts guide you in purchasing your term insurance.

| Point to be noted: Before the 2015 amendment to Section 45 of the Insurance Act, insurers could reject policies decades later by citing misstatements that caused family uncertainty. The amendment brought in the 3-year cutoff, giving policyholders stronger protection and boosting trust in life insurance. After the amendment, many life insurers raised questions about how to apply the new rules, especially in cases where a policy is rejected due to misrepresentation or suppression of facts. Click here to know what IRDAI clarified. |

What is the Significance of the 3-Year Rule in Term Insurance?

An insurance policy works best when built on mutual trust between the insurer and the insured, guided by the principle of Utmost Good Faith (Uberrima Fides ie. both the insured and the insurer to be completely honest and transparent in an insurance contract, fully disclosing all material facts that could influence the other party's decision about the risk or the premium)

- The insured must fully disclose all relevant details, such as health conditions, lifestyle habits, occupation, and existing coverage, that may impact risk assessment.

- The insurers are bound by IRDAI regulations to clearly communicate the policy’s features, exclusions, limitations, and terms.

- All marketing material, brochures, and sales presentations must accurately reflect the policy wording to ensure transparency and avoid misleading the customer. Trust and clarity are essential for a fair insurance relationship.

The 3-year rule is critical because it limits the insurer's right to investigate or deny claims.

Why it matters:

- After 3 years, insurers cannot cancel or question the policy on any ground.

Practically, if the fraud goes to the root of the contract (e.g., fake identity, faked death), insurers don’t treat it as a Section 45 issue. Instead, they argue that no valid contract existed, and they can reject the claim and even pursue criminal action.

- It offers claim assurance and peace of mind to the nominee.

- It encourages policyholders to make early and honest disclosures.

How Does the 3-Year Clause Affect the Life Insurance Claim?

Now that the 3-year rule in life insurance sounds like a solid guarantee, you will probably be wondering:

If the insurers can't question policies after 3 years, why aren't claim settlement ratios 100%?

It's a fair point. Shouldn't every legitimate claim be paid if insurers are bound to honor claims post-3 years? In theory, yes, but in reality, the claim settlement ratio is influenced by several other factors. While the 3-year clause offers strong protection, it doesn't cover all scenarios.

Here's why:

- Claims may be rejected within 3 years: Not all claims occur after three years; many happen earlier. Under Section 45(2) of the Insurance Act, insurers can investigate and reject claims within the first 3 years if fraud or material misrepresentation is found.

2. Incomplete or incorrect documentation- Sometimes, claims are delayed or denied due to missing paperwork, nominee disputes, or inconsistent medical records.

3. Fraudulent claims: Insurers do come across fake claims, forged death certificates, or intentional non-disclosure of critical illnesses which can lead to rejections any time.

So, while the 3-year clause protects long-standing policies, it doesn't apply to every claim, and that's why claim settlement ratios are not 100%.

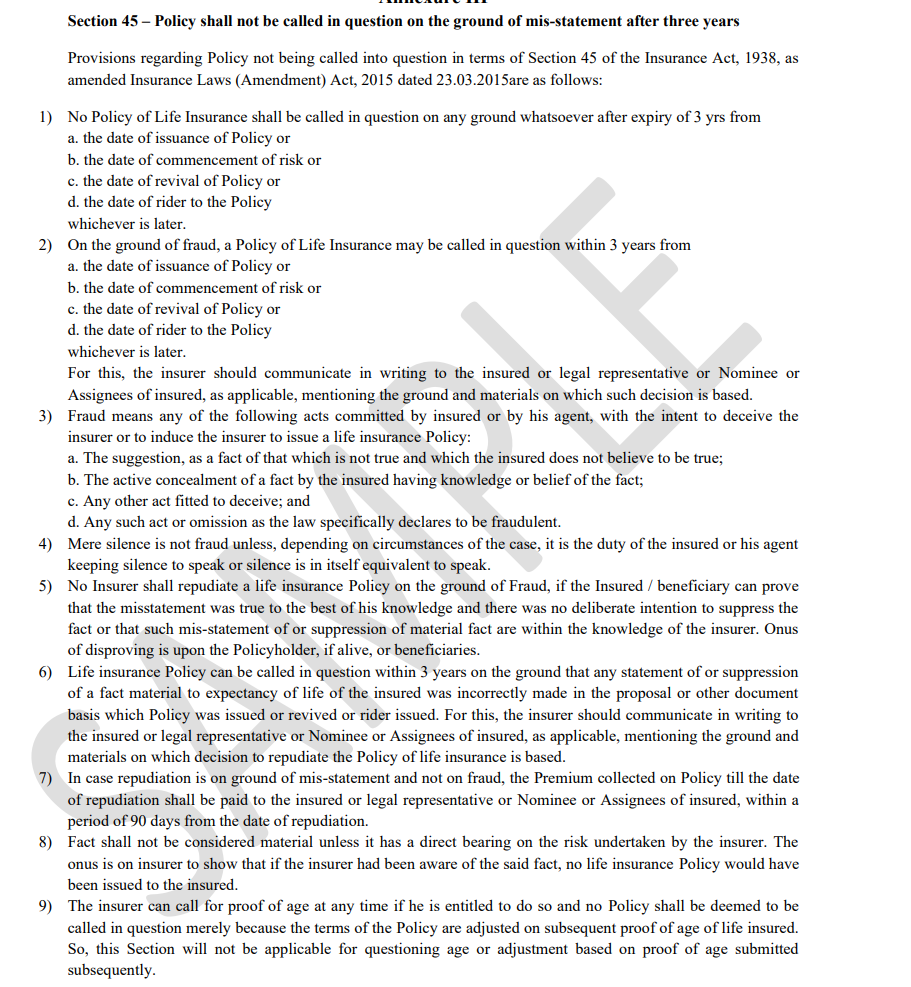

Here’s an extract from the policy wording of a popular insurer with Section 45's excerpt:

| Did You Know? Your insurer can review your policy anytime within the first 3 years, even if you haven’t made a claim. Random checks may include home or workplace visits, cross-verifying details with other insurers, or checking records with the Insurance Information Bureau (IIB). These reviews help spot errors or misstatements early, ensuring your policy stays valid and your future claims aren’t at risk. |

What are the Exceptions of the 3-Year Clause in a Life Insurance Policy?

The 3-year clause offers strong protection, but it has a few important exceptions, especially within the first 3 years.

1. Fraud:

If the policyholder commits fraud, the insurer can reject the claim within 3 years. As per Section 45(2), fraud includes:

- Suggesting as fact something that is not true and not believed to be true.

- Active concealment of a fact with knowledge/belief of that fact.

- Any other act fitted to deceive.

- Any act/omission the law declares fraudulent.

| Note: After 3 years, a policy cannot be denied, even on grounds of fraud, only if the insured or beneficiaries can prove the statement was made in good faith, there was no intent to deceive, or the insurer was already aware of the fact. |

2. Misstatement or Material Suppression of Fact:

Even if it’s not fraud, the insurer can repudiate the policy within 3 years if a critical fact was misrepresented or suppressed. But the insurer must:

- Prove that the fact was material to risk assessment. The insurer is responsible for proving materiality and that no policy would have been issued had they known the fact. After 3 years, even misstatement/suppression cannot be grounds for rejection.

- Provide written notice

- Refund premiums within 90 days

3. Age Misstatement

This is never a reason to cancel a policy. The insurer can ask for proof of age at any time and adjust benefits or premiums based on the correct age. This is the only permanent exception to the 3-year rule, meaning age can be corrected even after 3 years, unlike fraud or misstatement/suppression.

| Keep in mind: 1. Fraud can be committed by you or your agent If your agent hides facts or gives false information in your proposal, the law treats it as if you committed fraud. 2. Silence isn’t always fraud Not disclosing something isn’t fraud unless you (or your agent) are duty-bound to reveal it, or keeping quiet is the same as giving false information. 3. Whose agent is it really? Section 45 says that the person who sells and negotiates your policy is legally the insurer’s agent. So, whatever the insurer’s agent knows while selling the policy is treated as knowledge of the insurer itself. |

Understanding the differences between misstatement, suppression of facts, and fraud is crucial in insurance. Let's take a quick look at the table to know the distinction:

| Aspect | Misstatement | Suppression of Facts | Fraud |

|---|---|---|---|

| Definition/Meaning | An incorrect statement made in the proposal/other documents but without intent to deceive. | Non-disclosure/suppression of a material fact affecting expectancy of life in the proposal/other documents. | Acts with intent to deceive or cheat to induce issuance. |

| Intent required | Usually unintentional — mistake, oversight, or lack of knowledge. | May be intentional or unintentional, depending on whether the insured knew it was material. | Always intentional, Requires intent to deceive (explicit in fraud definition). |

| Materiality threshold | Must be material to risk/expectancy of life. Not material unless it has a direct bearing on underwriting. | Same as misstatement: material with a direct bearing on risk. | In practice always material by nature as it goes to the root of the contract., but the statute focuses on intent rather than a separate “materiality” test. |

| Who must prove what | Insurer’s duty to show materiality and that, had they known, no policy would have been issued. | Insurer’s duty (same as misstatement). | Fraud claims (within 3 years) can fail if the insured proves no intent to deceive or the insurer knew the fact. If a policyholder has died, the burden of disproving lies on the beneficiaries. |

| Treatment under Section 45 | - Within 3 years: Policy can be repudiated if material, but insurer must refund premiums. - After 3 years: Cannot be questioned. |

- Within 3 years: Policy can be repudiated if insurer proves suppression of a material fact. (Premiums refunded if repudiated for non-fraud). - After 3 years: Cannot be questioned. |

Within 3 years, policies can be rejected for fraud unless the misstatement was unintentional. After 3 years, even fraud can't void the policy, except in extreme cases like fake death or identity. |

| Outcome if repudiated within 3 years | If repudiation is not on fraud but due to misstatement/suppression: premiums collected must be refunded within 90 days to insured/nominee/legal heirs/assignees. | Same as misstatement (non-fraud): refund premiums within 90 | No refund obligation stated for fraud. Instead, repudiation depends on whether insured/beneficiaries can disprove fraud. |

| Examples | Stating weight as 70 kg instead of 72 kg. Writing the wrong year of diagnosis in medical history. | Not disclosing smoking habit, existing illness, or hazardous occupation. | Hiding cancer diagnosis, faking medical reports, giving false identity, or faking death. |

How Do Courts Handle Term Insurance Claims Under Section 45?

Understanding how disputes arise and are handled can help you better navigate the 3-year contestable period.

- Most disputes arise within the first 3 years: This “contestable period” allows insurers to reject claims for fraud or misstatement under Section 45. Early claims often trigger investigations into medical history and lifestyle disclosures.

- Courts demand strict compliance from insurers: Insurers must provide written reasons and evidence for repudiation and give beneficiaries a chance to respond. Minor non-disclosures (like mild BP or headaches) are not considered material.

- Courts lean toward consumer protection: Since the 2015 amendment, courts view Section 45 as a safeguard for honest policyholders, not a tool for insurers to deny genuine claims.

Here’s a look at some notable case law:

Post-2015 cases: High Courts have struck down repudiations where insurers failed to provide written reasons as mandated under Section 45.

1. Jollyrani Mohapatra vs LIC of India (2016, Orissa HC)

The court held that once 3 years have passed from policy issuance (or later of issuance/commencement/revival/rider), no insurer can question the policy on any ground whatsoever, including fraud. LIC’s repudiation beyond 3 years was struck down.

2. Haresh Thadani vs HDFC Life (2025, Vadodara Consumer Forum)

Policyholder died within 3 years; insurer repudiated, citing non-disclosure of heart disease. The forum ruled that mere non-disclosure is not enough; the insurer must prove the fact was material and directly related to risk. Since HDFC Life failed to confirm this, the repudiation was invalid, and the claim was allowed.

Ditto’s Take on the 3-Year Clause in Term Insurance

At Ditto, we believe the 3-year clause is one of the strongest consumer protections in Indian insurance law. It rewards honesty and protects families from unnecessary stress during a claim.

We always remind our users that even minor oversights can lead to significant issues later. That’s why we say:

- Always disclose smoking or drinking habits, even if occasionally.

- Don’t hide past or existing health conditions like diabetes or hypertension.

- Update your details during policy revival or when adding riders.

- Never sign/ submit proposal forms without reading what’s filled in—double-check everything, even if an agent helps.

These honest disclosures protect your claim, especially during the first 3 years when insurers can still investigate and reject policies for misrepresentation.

Why Talk to Ditto for Your Term Coverage?

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Arun below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 5,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Key Takeaways

To wrap it up, here’s what the 3-year clause really means for your term insurance policy:

- Stronger protection after 3 years: Once your policy completes 3 years (from issue, revival, or rider), it can’t be questioned—except for proven fraud.

- Claim confidence: Your family’s claim is largely secure, offering peace of mind.

- Fraud still matters: Deliberate misstatements can lead to rejection within 3 years.

- Honest disclosures help: Being truthful at purchase gives you long-term legal protection.

- Keep it active: A continuously active policy holds stronger legal standing.

Still unsure how to make sure that the 3-year clause works in your favor? Book a free call with us and let our experts guide you in purchasing your term insurance.]

Frequently Asked Questions (FAQs)

If there was a misstatement, can the insurer still reject the claim for fraud?

Not always. Even within the first 3 years, a claim can’t be denied for fraud if the misstatement was made in good faith, there was no intent to deceive, or the insurer already knew the fact, and proof lies with the policyholder or beneficiaries.

How does Section 45 help insurers?

Section 45 gives insurers a 3-year window to question life insurance policies for fraud, misstatement, or non-disclosure. It ensures honest disclosures upfront, allows age verification anytime, and balances early protection for insurers with long-term security for policyholders.

Are Lifestyle Changes Allowed After Buying Term Insurance?

Yes. The 3-year clause covers disclosures made at the time of purchase. Changes (e.g., starting to smoke, gaining weight, developing a new illness, job risk changes) made/happening after policy issuance don't affect the policy's validity. However, if you're reviving a lapsed policy, the 3-year clock resets from the revival date.

Does Section 45 apply to health insurance policies too?

No.Life insurance is protected after 3 years (Section 45); health insurance after 5 years of continuous renewal (Moratorium Period), giving you long-term claim security and protection from old disputes.

Who Has the Burden of Proof in Case of Fraud After Death?

If the policyholder has passed away, the insurer must prove the fraud unless the beneficiaries can show that the misstatement/non disclosure was not intentional.

Last updated on: