Buying term insurance is one of the most important financial decisions you’ll make. It acts as a safety net; if something happens to you, your family shouldn’t worry about bills, children’s education, or loans.

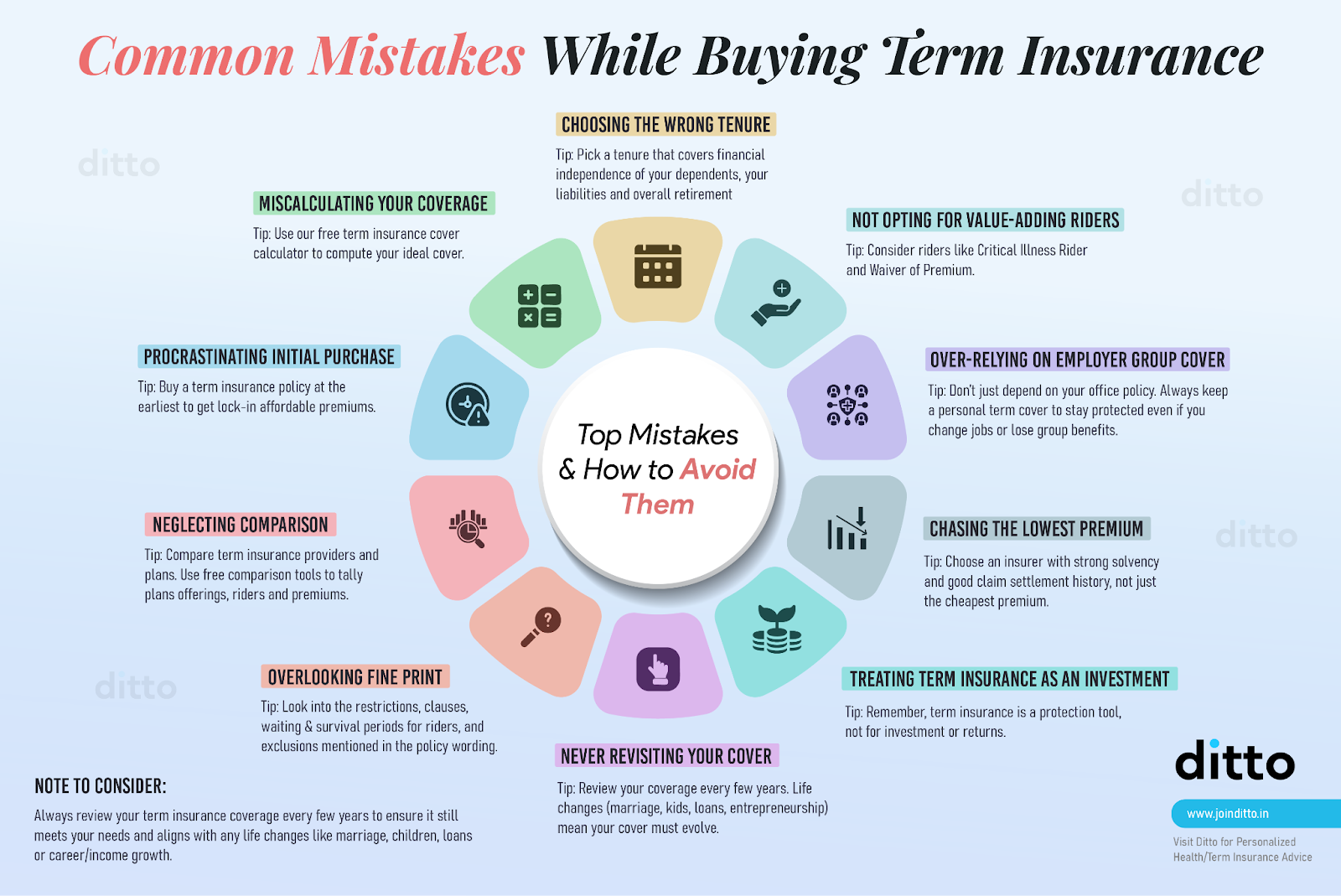

Yet many people in India make mistakes while buying term insurance. They buy too little coverage, opt for cheaper plans without understanding claims, or forget to update coverage after major life changes like marriage, children, or loans.

These errors happen because insurance can be confusing, with multiple plans, riders, and fine print. Without proper guidance, it’s easy to choose a plan that looks good on paper but doesn’t truly protect your family.

At Ditto, we’ve reviewed thousands of claims and helped countless families. Certain mistakes keep recurring, but the good news is that they are almost all avoidable.

Here are the most common term insurance mistakes, their impact, and how to avoid them.

Friendly reminder: It’s easy to get lost comparing policies and premiums. Instead of spending hours on it, why not get personalised insurance advice from Ditto? We offer free consultations with zero spam! Just 30 minutes to clarify all your doubts. So book a call now.

Mistake 1: Buying a Small Cover

Have you ever thought, “₹25 lakh or ₹50 lakh sounds like a big number, surely that’s enough”? But once you break it down: monthly expenses, children’s fees, EMIs, healthcare costs, and inflation, you’ll realize the money runs out much faster than you expect.

Imagine your family’s monthly expenses are ₹50,000. With ₹50 lakh, the payout will last less than 9 years, even less if you add inflation and emergencies. What happens after that? That’s the danger of underinsuring yourself; your family’s financial safety net vanishes too soon.

At Ditto, we go a step further. Instead of just replacing your income with a broad 10–15× multiplier, we dig into your actual lifestyle and responsibilities.

We ask questions like:

- How much does your family spend each month?

- For how many years will they need support?

- Are there any big future expenses, like children’s higher education, marriage, or pending loans?

- Do you need a buffer for unpredictable events?

This approach ensures that the cover amount we recommend is realistic and relevant, one that truly allows your dependents to maintain their lifestyle if you weren’t around. And even if you slightly over-insure, we make sure it’s still within a logical and affordable range.

Mistake 2: Buying for a Longer Age (like till 80–99 years)

It sounds attractive, doesn’t it? “Cover till 99 years!” But do you really need term insurance when you’re 80 or 90? By that time, your children are usually independent, loans are cleared, and your retirement corpus should take care of you.

When you buy such long-tenure plans, the premium is extremely high because insurers know they’ll almost certainly have to pay.

The smarter approach is to buy cover only until your retirement age (60–70). That’s when your family is financially dependent on you. After retirement, your savings and investments should ideally support you.

Mistake 3: Buying Return of Premium (ROP) Plans

“Why waste money? At least I’ll get something back!” That’s the pitch behind ROP plans. But here’s the truth: ROP plans cost 50–100% more than pure term insurance, and what you “get back” is just your own premiums, without any growth or interest.

For example, if you pay ₹20,000 annually for 30 years, that’s ₹6 lakh in premiums. After 30 years, you’ll get back ₹6 lakh. However, due to inflation, that money will lose value over time and could be worth only around ₹1-1.5 lakh in today’s terms. So while it feels like a “refund,” you’re actually losing out on growth.

Buy a pure term plan. If you feel bad about “losing” premiums, think of it as paying for peace of mind. Alternatively, invest the difference in mutual funds or fixed deposits, and you’ll likely have much more money in hand later.

Mistake 4: Buying All Add-ons

There are several add-ons available, such as accidental death, critical illness, hospital cash, and waiver of premium riders, but do you really need all of them?

When you add every possible rider, your premium can increase significantly. In many cases, some riders overlap with existing coverage. For example, if you already have a health insurance plan, a hospital cash rider adds little extra value. Similarly, if your term plan’s sum assured is already sufficient, an accidental death benefit rider may not provide meaningful additional protection, since the base plan already covers death due to accidents.

Be selective. Two riders that usually make sense are:

- Waiver of premium (in case of critical illness/disability): If the policyholder becomes critically ill or disabled and is unable to work, they may struggle to pay future premiums, risking the policy lapsing. This rider ensures that all future premiums are waived, keeping the coverage active.

- Critical illness cover: On diagnosis of a serious illness such as cancer or heart disease, this rider pays a lump sum upfront. The amount can be used for treatment, EMIs, or daily expenses, beyond what health insurance covers.

Mistake 5: Not Buying Important Add-ons

While some buyers overload their policies with unnecessary riders, others skip add-ons that could make a critical difference. For example, if a policyholder suffers a disability and can no longer work, the term plan may lapse simply because premiums cannot be paid. Similarly, a major illness or accident can strain finances far beyond what health insurance alone covers.

Choose riders that address real risks, as they can significantly strengthen a term plan when selected wisely. For example, an Accidental Disability & Income Benefit Rider provides a steady income if a permanent disability occurs due to an accident, helping your household manage ongoing expenses without disruption.

Skipping the right riders can weaken a term plan. Adding waiver of premium, critical illness, and accidental disability benefits provides holistic protection at minimal extra cost.

Mistake 6: Buying from a Very Small Insurer

A smaller insurer offering cheaper premiums can seem attractive at first glance. However, the real test of an insurance company is not how little it charges, but how reliably it settles claims. If the insurer has a weak claim settlement ratio or poor solvency ratio, the family may face delays, disputes, or even outright rejection at claim time. What begins as a money-saving decision could leave dependents financially vulnerable.

Before finalizing a term plan, buyers should always check an insurer’s fundamentals. A claim settlement ratio above 97% indicates consistency in honouring claims. A solvency ratio of at least 1.5, as mandated by IRDAI (higher the better), shows financial stability and the ability to pay future claims.

A high complaint record is a clear red flag of weak service and potential claim hassles. Additionally, look for companies with annual business volumes of at least ₹5,000 crore, which reflects scale and experience.

Equally important are the insurer’s reputation and customer service, including how promptly they respond and how efficiently they guide families through the claims process. Mistake 7: Under-disclosing Health, Habits, or Occupation

It’s common for buyers to think, “If I don’t mention my smoking habit, medical condition, or risky job, I’ll get a cheaper premium.” But this shortcut can backfire badly. Insurers investigate claims thoroughly, and if they discover any hidden information, whether it’s smoking, past illnesses, high-risk hobbies, or job details, they can reject the claim outright. The result? This could result in your family not receiving any payout, even after years of paying premiums.

Be completely transparent when filling out the proposal form. Mention health conditions, lifestyle habits like smoking or drinking, and details of your occupation honestly and to the best of your knowledge. Yes, premiums may increase slightly, but this ensures your policy remains valid and your family’s claim stands strong. Remember, insurers price risk into the premium; hiding facts only risks the entire claim.

Mistake 8: Over-relying on Employer Group Cover

Many salaried professionals feel secure because their employer provides group life insurance. While it’s a nice perk, the cover is usually very small, often just ₹10–₹50 lakhs, and disappears the moment you change jobs, get laid off, or retire. Imagine losing your job during a recession and realizing that, overnight, your family is left without any protection. Depending solely on this cover creates a false sense of security.

Treat employer-provided insurance as an extra layer of protection, not the primary one. Always purchase a personal term insurance policy that stays with you regardless of where you work. This way, even if you switch jobs, pursue a business or step away from employment, your family’s financial security remains intact.

Mistake 9: Chasing the Lowest Premium

Some insurers undercut premiums to attract buyers but may have poor claim settlement records, weak solvency, or slow service. You might save a few hundred rupees a year, but at claim time, your family could face delays or disputes.

Instead, balance affordability with reliability. Check claim settlement ratios, solvency, complaints, and service quality. Remember, term plan premiums are fixed for the entire duration, so a slightly higher premium now is a small cost over time, especially as inflation works in your favour.

Mistake 10: Selecting the Wrong Payout Mode

The purpose of term insurance is to give your family financial security, but that depends not just on the cover amount, but also on how the payout is structured. Suppose the family has a large home loan, but the policy payout is set to pay a monthly income. They may struggle to clear the debt.

On the other hand, if the entire payout comes as a lump sum and the family isn’t used to managing large amounts, the money could get misused or exhausted too soon if not invested properly. In both cases, the cover fails to serve its true purpose.

Choose a payout option that matches your family’s financial habits and needs:

- Lump Sum (Ditto recommended): Best if the family needs to clear big, immediate liabilities like loans and can handle the payout well financially.

- Monthly/Staggered Income: Useful if dependents need steady support for living expenses.

- Combination: Some insurers allow part lump sum and part monthly income, a balanced option for many families.

Mistake 11: Letting the Policy Lapse

A term insurance policy only works if it’s active. Missing even a few premium payments can cause the policy to lapse, which means there’s no cover at all. Reviving a lapsed policy often comes at a cost; insurers may charge extra, demand fresh medical tests, or in some cases, refuse revival altogether if new health issues have developed. Essentially, years of disciplined premium payments can go to waste, leaving the family unprotected.

The simplest way to avoid this mistake is to set up auto-debit mandates from your bank account or credit card and keep reminders for renewal dates. Even if finances are tight, prioritize your term premium; it’s usually small compared to the security it provides. Remember, letting a policy lapse defeats the entire purpose of buying insurance in the first place.

Mistake 12: Never Revisit Your Cover

Buying a term plan isn’t a one-time exercise. Life keeps changing: marriage, children, a new home loan, career growth, and with each milestone, responsibilities grow. But the cover often remains the same. That creates a dangerous gap: the family’s needs increase, but the protection doesn’t. If something happens, the payout may no longer be enough to cover all commitments, leaving loved ones under-protected.

Review your cover every 3–5 years or after major milestones. A good practice is to revisit the plan together as a couple, husband and wife, sitting down to assess expenses, liabilities, and future goals. Discuss questions like:

- How much do we spend each month?

- Do we have new loans to repay?

- How are we planning for children’s education or marriage?

- Has our lifestyle or income changed?

Based on the answers, either increase the existing cover (if the insurer allows) or buy an additional policy. This joint approach ensures both partners are aligned, and the family’s long-term security keeps pace with life’s changes.

Mistake 13: Not Preparing for Medical Tests

When you apply for term insurance, insurers usually require a health check-up depending on your age, sum assured, and medical history. This can include tests for blood sugar, cholesterol, blood pressure, and other health indicators. If any of these results are high or abnormal, the insurer might either increase your premium or, in some cases, reject/postpone your application.

The key is to be proactive. Get a health check before applying for the policy. If the results aren’t ideal, you have time to improve them through better diet, regular exercise, quitting smoking, or managing stress. This can help you secure a lower premium and also encourage a healthier lifestyle overall.

Mistake 14: Delaying Term Insurance Because You’re Young

Most people think they don’t need insurance because they are young and healthy. While it may seem unnecessary, postponing term insurance can cost you more in the long run. Premiums are lower when you’re younger, and getting coverage early ensures financial protection for your loved ones if the unexpected happens.

Buying late means higher premiums, more medical scrutiny, and the risk of being underinsured when responsibilities like marriage, children, or loans increase. Starting early locks in affordability and peace of mind, letting you focus on building your future without worry.

Mistake 15: Ignoring Nomination/Beneficiary Details

Even if your insurance policy has a nominee correctly listed, problems can arise if your family doesn’t know who it is or how to claim the payout. Insurers may face delays in processing claims, and your loved ones could struggle to access the funds when they need them most.

Always communicate with your family about your policy details: who the nominee is, how to claim, the agent’s contact, and where the documents are kept. Also, update the nominee details with the insurer whenever there are major life changes like marriage, the birth of a child, or divorce. Clear communication and updated records ensure a smooth claim process and reduce stress for your family.

Why Talk to Ditto for Term Insurance?

Don’t worry! You don’t have to figure it all out alone. Whether it’s choosing the right plan, understanding the fine print, or preparing for medical checkups, Ditto’s got your back.

✅ 100 percent unbiased advice

✅ 12,000 plus 5-star reviews (Rated 4.9 on Google)

✅ Trusted by Zerodha and built on real claim experience

You can schedule a FREE consultation, but hurry, slots are filling up fast! Book your call today.

Ditto’s Take on Common Term Insurance Mistakes in India

Term insurance is simple in theory, but easy to get wrong in practice. The mistakes we discussed, whether it’s buying too little cover, chasing cheap premiums, or ignoring important add-ons, can turn a safety net into a trap.

But the solutions are straightforward: calculate the right cover, choose the right tenure, disclose honestly, and review your policy regularly. Do this, and your family’s financial future will truly be protected.

Frequently Asked Questions (FAQs)

Do I need to buy term insurance even if I’m very young and healthy?

Absolutely! Buying early locks in lower premiums and ensures your family is financially protected from day one. Waiting until later can mean higher costs and more medical scrutiny.

What happens if my life circumstances change after buying a policy?

Major life events like marriage, having children, or taking a loan can increase your family’s financial needs. It’s important to revisit your cover periodically and adjust it to keep your protection adequate. Instead of dropping your plan, review coverage and add extra protection through the same plan or a new policy.

How can I make sure my family can easily claim the insurance?

It’s not enough to just name a nominee. Share policy details, claim procedures, and document locations with your family. This ensures they can access the payout quickly and without unnecessary stress.

Last updated on: