| What is the Waiting Period in Maternity Insurance? The waiting period in maternity insurance refers to the time you must wait after purchasing a health insurance policy before you can claim maternity-related expenses, including delivery, prenatal, and post-natal care. During this period, if you incur maternity expenses, the insurer will not cover them. This clause ensures that people do not buy a policy only when they are already pregnant and immediately claim benefits. |

Every single day, over 67,000 babies are born in India; that’s a lot of joyful beginnings! But for expecting parents, these moments also come with big financial responsibilities. From hospital delivery charges to newborn care, costs can quickly add up.

This is where maternity health insurance steps in. However, one critical clause you need to understand before buying a policy is the waiting period in maternity insurance. In this guide, we’ll explain what the waiting period in maternity insurance means, why it exists, how it can be reduced, and which plans offer the best value according to Ditto.

Waiting Period in Maternity Insurance

Health insurance policies come with different waiting periods to prevent misuse and maintain fairness. Among them, maternity waiting periods are usually the longest and very crucial to understand.

Maternity Waiting Period

If your policy includes maternity benefits, you generally can’t claim expenses for pregnancy or childbirth immediately after purchase. Most insurers impose a waiting period of 2 to 4 years before maternity-related costs, such as normal delivery, C-section, and related expenses, are covered. Some comprehensive plans or maternity riders reduce this to 9 months or 1 year, but these options are rare and usually come with higher premiums.

Other Waiting Periods (at a glance)

- Initial Waiting Period: Typically 30 days for all new policies (accidents are covered from day one).

- Specific Disease Waiting Period: 1 to 2 years for certain procedures like cataract, hernia, or joint replacement.

- Pre-existing Disease (PED) Waiting Period: 1 to 3 years, depending on the plan, for conditions like diabetes or hypertension.

Planning a family soon? Don’t wait till it’s late. Compare top maternity health insurance plans now and book a FREE consultation with Ditto’s advisors!

Why is There a Waiting Period in Maternity Insurance?

The main reason is to prevent adverse selection. If insurers allowed immediate coverage, individuals could purchase the policy immediately after discovering their pregnancy, claim benefits, and then discontinue the policy. This would create a financial imbalance for insurers and make premiums unaffordable for everyone.

The waiting period ensures long-term participation, stabilizes risk, and helps insurers keep premiums reasonable for everyone in the pool.Note: Not all health insurance plans cover maternity or newborn expenses. These benefits are usually offered either as part of a comprehensive plan or through add-ons. If maternity coverage is important, it is essential to choose a plan with these features at the time of purchase, as most insurers do not allow adding maternity benefits later.

Can the Waiting Period in Maternity Insurance be Reduced?

Yes, some insurers offer reduced waiting period add-ons, which allow you to shorten the standard waiting time for certain benefits. However, these add-ons usually come at an additional premium.

For example, ICICI Elevate offers a Maternity Add-on that provides extra coverage for maternity-related expenses, including childbirth. Under this add-on:

- Coverage is limited to 10% of the base sum insured, subject to a maximum of ₹1 lakh.

- The maternity waiting period typically ranges from 1 to 2 years.

Additionally, this policy includes Surrogate & Oocyte Cover, offering protection for costs related to a surrogate mother and oocyte donor, with coverage of up to ₹5 lakhs.

Can Pregnant Women Get Maternity Insurance with a Reduced Waiting Period?

Typically, no insurer provides maternity coverage to women who are already pregnant, as pregnancy is considered a known event, not an unforeseen risk. The lowest waiting period we’ve seen in retail policies is 9 months, under the Niva Bupa Aspire Titanium+ plan.

However, there is a unique exception worth noting:

- Star Health’s Super Star Plan with Women Care Add-on: This add-on allows pregnant women to buy the policy by submitting their 12-week and 20-week scan reports. Under this feature, the newborn is covered immediately after birth, and the coverage continues till the end of the policy year.

Additionally, group health insurance policies from employers often provide maternity benefits with minimal or no waiting period, so it’s always worth checking your employer’s coverage. For retail policies, it’s best to plan well before conception to take full advantage of maternity benefits.

How Are Newborns Covered After Birth?

1. When the Plan Includes Maternity Coverage

- Immediate Coverage: Policies with maternity benefits cover the newborn from birth.

- Coverage Limits: Expenses are usually deducted from the maternity sum insured, not the base health cover.

- Additional Protection: Some plans, such as Niva Bupa Aspire Titanium+, ICICI Lombard Elevate, and Star Health Super Star, offer separate or additional coverage for the newborn.

- After 90 Days: Once the child is 90 days old, they can be added as a dependent under the main policy and enjoy full family floater coverage.

2. When the Plan Does Not Include Maternity Coverage

- No Coverage at Birth: Standard health plans without maternity benefits do not cover newborns immediately after birth.

- Eligibility After 90 Days: The child can be added only after completing 90 days.

- Underwriting Required: The insurer may ask for medical checks or additional disclosures before approving coverage.

Maternity Health Insurance Plans That Make Ditto’s Cut

| Before we jump into the list, here’s how we decide what “best” means. At Ditto, every plan goes through our six-point evaluation framework. This framework is why we’re comfortable using the word “best.” It doesn’t mean these are the only good plans, but that they stand out after being scored across all six pillars. You can learn more about how we evaluate the plans here. |

When choosing maternity health insurance, don’t just compare premiums; also consider delivery limits, waiting periods, newborn care, and additional benefits like vaccinations or coverage for restoration. Here are Ditto’s Recommendations for comprehensive maternity coverage:

1. Aditya Birla Activ Fit Preferred (Maternity Inbuilt)

This plan is designed for active individuals and includes maternity as an inbuilt feature under family floater options.

Key Highlights:

- Maternity Coverage:

- Covers: (a) 2 deliveries (including twins), or (b) 2 terminations, or (c) 1 delivery (including twins) + 1 termination

- Normal Delivery: ₹40,000

- C-Section Delivery: ₹60,000

- Waiting Period: 3 years

- Pre- and post-natal expenses covered

- Newborn baby covered from birth till 90 days

- Vaccination expenses for the newborn up to 2 years

- Stem cell preservation costs covered (all within maternity limit)

Other benefits include no room rent restriction for sum insured of ₹5 lakh and above, no co-payment or disease-wise sub-limits, 90–180 days of pre- and post-hospitalization cover, unlimited sum insured restoration, wellness programs, mental health support, annual health checks, and a 10% upfront good health discount.

2. Niva Bupa Aspire Titanium+ (Maternity Inbuilt)

A unique plan that provides comprehensive maternity benefits along with innovative features like sum insured boosters.

Key Highlights:

- Maternity Coverage:

- Covers antenatal check-ups, vaccines, delivery, surrogacy, assisted reproduction (IVF, ICSI), medical termination, infertility treatment, and adoption-related charges

- Waiting Period: Only 9 months

- Coverage limits vary by base SI:

- ₹10L SI: ₹12,000

- ₹15L SI: ₹15,000

- ₹20L SI: ₹20,000

- Newborn covered up to base SI from Day 1 (Very rare)

- Vaccines like Tdap, Td, Flu Shot, Hepatitis A & B are covered

Other benefits include no room rent restrictions or disease-wise limits, unlimited sum insured restoration, entry-age-based premium locking (Lock the Clock) unaffected by general or maternity claims, and innovative add-ons such as Fast Forward (combining sum insured across 2–3 years) and Booster+ (carrying forward unutilized sum insured up to 10 times the base, including maternity coverage).

Note: Through the Fast Forward add-on, if you choose a base sum insured of ₹15 lakh, the policy may include maternity coverage of ₹15,000. However, with this add-on, if you opt for and pay for a multi-year policy of three years, you get ₹15,000 for each year combined into a single benefit. This means you receive ₹45,000 worth of maternity coverage after completing just a 9-month waiting period.

3. ICICI Lombard Elevate (Maternity Add-on)

A feature-rich plan where maternity coverage is offered as an add-on for families.

Key Highlights:

- Maternity Coverage:

- Available as an add-on, covers up to three claims for delivery (normal or C-section), medically advised terminations, and newborn hospitalization up to 2 times of the maternity sum insured.

- Covers up to 10% of annual SI, capped at ₹1,00,000

- Includes vaccination up to ₹10,000 for the newborn (if maternity & newborn covers are opted)

- Waiting Period: 2 years (can be reduced to 1 year via add-on)

- Covers surrogacy and oocyte donor expenses up to ₹5 lakhs

Other benefits include no co-payment or disease sub-limits, unlimited sum insured restoration, and add-ons such as Inflation Protector, Infinite Care (one lifetime claim with no sum insured limit), and Jumpstart (to reduce waiting periods for listed conditions).

4. Star Health Super Star (Maternity Add-on)

A versatile plan with multiple options for maternity coverage and assisted reproduction.

Key Highlights:

- Maternity Coverage:

- Option A:

- Waiting Period: 24 months

- Delivery Limit: ₹50,000 (Option 1) or ₹1,00,000 (Option 2) per delivery

- Option B:

- Waiting Period: 12 months

- Delivery Limit: ₹30,000 per delivery

- Option C: Assisted Reproduction Treatments (IVF, IUI) covered after 24 months, with limits ranging from 1 to 4L, depending on the sum insured chosen.

- Newborn covered from Day 1 if the mother is insured for 12+ months or the delivery claim is accepted for ₹2 or 5L, depending on the S.I.

- Option A:

Other benefits include no co-payment or disease sub-limits, unlimited sum insured restoration, and wellness add-ons like Women Care and Future Shield (which allows transferring waiting periods to a new spouse).

5. Tata AIG Medicare Premier (Inbuilt Maternity)

A premium plan with maternity built in and added value through wellness and global coverage.

Key Highlights:

- Maternity Coverage:

- Waiting Period: 4 years

- Coverage:

- Up to ₹50L SI → ₹50,000 (₹60,000 for girl child)

- ₹75L to ₹3 Cr SI → ₹1,00,000 (₹1,20,000 for girl child)

- Vaccination costs up to ₹10,000 (₹15,000 for girl child) for 1 year

- Covers delivery complications and newborn hospitalization

- Excludes pre-/post-natal expenses

Other benefits include no room rent limits or co-payment, global cover for planned hospitalization, and coverage for OPD dental treatments, home physiotherapy sessions, and high-end diagnostics.

Quick Plan Comparison Table

For this table, we have considered that you have opted for a sum insured of ₹15 lakh in Delhi with no pre-existing diseases. Here’s how the waiting period would apply, the delivery coverage would be provided, and the premiums for a couple who are both 30:

| Plan | Waiting Period for Maternity | Delivery Coverage | Premium for a Couple (30 yrs + 30 yrs) |

|---|---|---|---|

| Aditya Birla Activ Fit Preferred | 3 yrs | ₹40k Normal / ₹60k C-Section | ₹20,457.14 (maternity coverage is in-built) |

| Niva Bupa Aspire Titanium+ | 9 months | ₹15k (15L SI, can be accumulated as well) | ₹23,675 (maternity is inbuilt) |

| ICICI Elevate | 2 yrs (1 yr optional maternity reduction rider) | 10% of SI (max ₹1L) | Total Premium: ₹70,081 Maternity Rider Premium: ₹53,710 Base Premium: ₹16,371 |

| Star Health Super Star | 2 years | ₹30k–₹1L (varies by option, we have selected Option A with Maternity SI 1L) | Total Premium: ₹43,351 Maternity Rider Premium: ₹28,563 Base Premium: ₹14,788 |

| Tata AIG Medicare Premier | 4 yrs | ₹50k (₹60k girl child as we have chosen an SI of less than 50L) | ₹28,929 (maternity coverage is in-built) |

Key Insights:

- If you want the highest maternity sum insured, ICICI Elevate (up to ₹1L) and Star Health Super Star (₹30k–₹1L) are the top choices, though they require paying extra for maternity riders.

- Niva Bupa Aspire Titanium+ is a great pick for those wanting a shorter 9-month waiting period with the option to accumulate maternity SI by paying for 3 years upfront.

- Aditya Birla Activ Fit Preferred and Tata AIG Medicare Premier offer in-built maternity cover at competitive premiums, but with longer waiting periods and lower limits.

Why Choose Ditto for Health Insurance

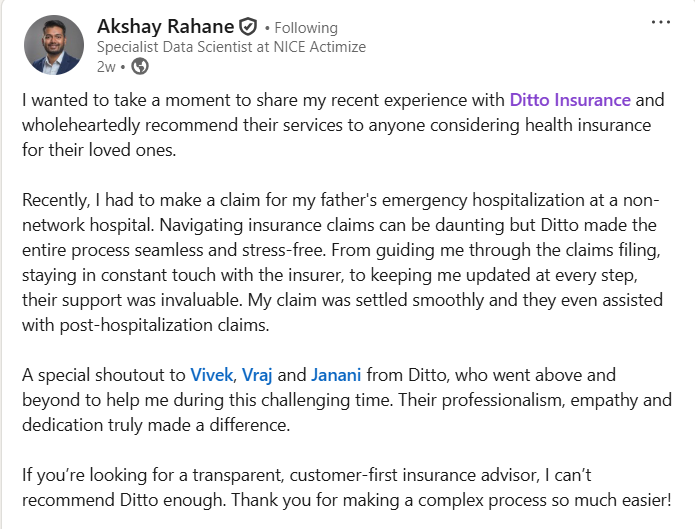

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right IPD or OPD health insurance policy. Here’s why customers like Akshay love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Is Maternity Health Insurance Worth It Despite the Waiting Period?

Maternity insurance is a crucial investment for anyone planning to start a family, but understanding the waiting period is key to avoiding surprises. Since most plans require 9 months to 4 years before maternity benefits apply, early planning is essential. Compare plans not just on premium but also on waiting periods, delivery limits, and newborn care features to find the right fit for your family’s needs.

If you’re currently employed, check if your employer-provided health insurance includes maternity benefits, as these often come with zero waiting period, making them a valuable option for immediate coverage.

FAQs

What happens if pregnancy occurs during the waiting period in maternity insurance?

If you conceive during the waiting period in maternity insurance, you cannot claim expenses related to pregnancy or delivery. Coverage will only start after the waiting period ends. That’s why it’s important to buy a policy well in advance of planning a family.

Can I reduce the waiting period in maternity insurance?

Yes, some insurers offer riders or add-ons to reduce the waiting period for maternity benefits, usually at an extra premium. For example, certain plans allow reducing a 2-year waiting period to 1 year. However, these options must be chosen at the time of purchase and cannot be added later.

Is there any health insurance plan with zero waiting period for maternity?

Retail health insurance plans do not offer zero waiting period for maternity coverage. However, many employer-provided group health insurance policies include maternity benefits with no waiting period, making them a great option if you need immediate coverage.

When does newborn coverage start under maternity health insurance?

If your plan includes maternity coverage, the newborn is usually covered from birth until 90 days under the maternity limit. After 90 days, the baby can be added as a dependent to the family floater plan. If your plan does not include maternity benefits, the child can only be added after 90 days.

Last updated on: