Quick Overview

When you buy a health insurance policy, you expect a smooth experience during medical emergencies. However, the insurer often isn't the one handling your claims directly. Instead, they outsource this task to an intermediary known as a health insurance TPA.

Based on the latest IRDAI Annual Report 2024-25, 69% of the claims (approximately 2.25 crore claims) were processed by Third-Party Administrators (TPAs), while the remaining 31% were handled through in-house mechanisms. This highlights their dominance in the health insurance industry.

Understanding what a health insurance TPA does and its impact on your claim experience is crucial for choosing the right policy. In this article, we will delve into the role of TPA in health insurance, its benefits, drawbacks, and why Ditto recommends looking for insurers with in-house claim teams.

What is the Role of Health Insurance TPA?

- Policy Servicing & Health Cards: Issues physical or digital health cards, maintains policyholder details, and assists with basic service requests.

- Network Hospital Coordination: Supports insurers in working with network hospitals and helps ensure processes, paperwork, and systems are in place for smooth cashless treatment.

- Cashless Claim Coordination: Works with hospitals and insurers to handle pre-approvals for cashless treatment, checks required documents and supports cashless claim processing as per policy rules.

- Reimbursement Claim Processing: Collects and checks bills and medical records for reimbursement claims, guides policyholders on documents needed, and forwards complete claims to insurers for final approval.

- Claims Scrutiny Support: Reviews claims for coverage, limits, exclusions, and missing information, while the insurance company makes the final decision to approve or reject the claim.

- Customer Support & Help Desks: Runs call centers and hospital help desks to help policyholders with claim intimation, cashless procedures, document submission, and claim status updates.

- Fraud Monitoring Support: Identifies unusual billing or claim patterns and alerts insurers to possible fraud, helping control costs and ensure proper claim handling.

- Reporting & Operational Support: Shares regular reports with insurers on claims performance, turnaround time, hospital service quality, and customer complaints to improve operations and service quality.

- Travel & Multi-Policy Claims Support: Some TPAs support claims and health service coordination for hospitalization under personal accident, domestic and foreign travel policies, including overseas treatment for Indian insurers’ policyholders and in India treatment for customers covered by foreign insurers.

- Value-Added Services: May provide supplementary support such as ambulance coordination, medical advice, or periodic health check-up programs.

Popular Health Insurance TPAs in India

- Medi Assist Insurance TPA Private Limited (recently merged with Raksha Health Insurance TPA Private Limited )

- Family Health Insurance TPA Limited

- MDIndia Health Insurance TPA Private Limited

- Paramount Health Services & Insurance TPA Private Limited

- Vidal Health Insurance TPA Private Limited (formerly TTK HealthCare TPA)

- HealthIndia Insurance TPA Services Private Limited

- Heritage Health Insurance TPA Private Limited

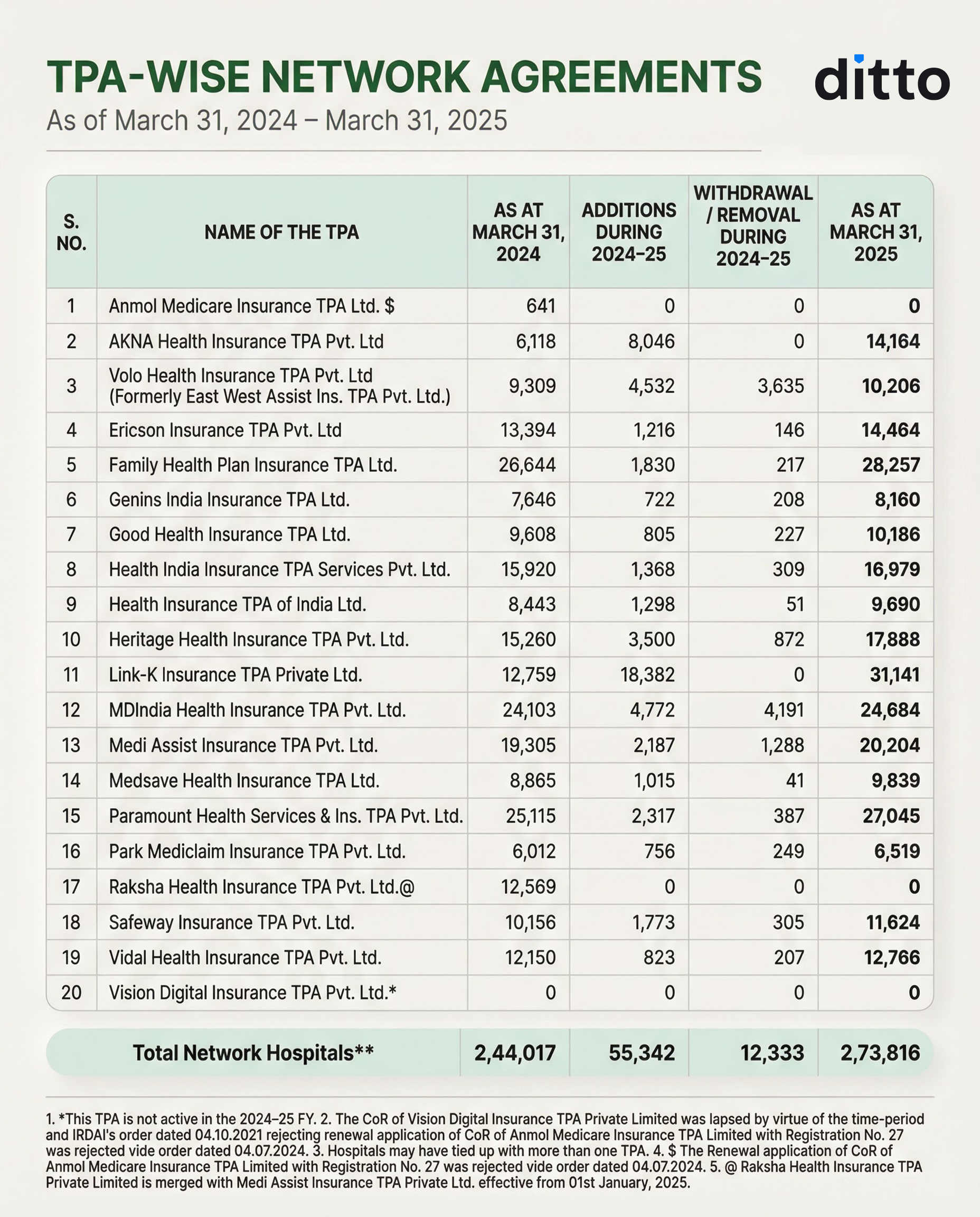

You may check the list of TPAs registered under IRDAI below.

TPA Claim Handling Process

Knowing what is TPA in health insurance is not enough; you must understand how they handle claims to manage expectations.

Cashless Claim Process

Admission

You are admitted to a network hospital and present your health insurance TPA card. This identifies you as eligible for cashless treatment.

Pre-Authorization

The hospital submits a pre-authorization request to the TPA, including estimated treatment costs and relevant medical details.

Review

The health insurance TPA reviews the request against your policy coverage, limits, exclusions, and network hospital protocols. They may seek additional information from the hospital if needed.

Approval

Once the review is complete, the TPA issues an authorization letter to the hospital, confirming that the insurer will cover eligible expenses. Treatment can proceed on a cashless basis, though the hospital may ask for an initial deposit for non-covered or provisional charges.

Post-Treatment Reporting

After you are discharged, the health insurance TPA collects the hospital’s final bills, checks them against the pre-approved estimate, and sends everything to the insurer.

Reimbursement Claim Process

- Treatment at Non-Network Hospital: If you receive care at a non-network hospital, you pay the hospital directly.

- Submission of Claim Documents: You submit all original medical bills, diagnostic reports, prescriptions, and discharge summaries to the TPA for claim processing.

- Verification: The health insurance TPA examines the submitted documents to ensure authenticity, completeness, and compliance with policy terms, checking for coverage limits, exclusions, and errors.

- Settlement Recommendation: The health insurance TPA forwards the verified claim, along with their recommendation, to the insurer. The insurance company evaluates and processes the reimbursement, and the eligible amount is credited to your account.

Benefits and Drawbacks of Health Insurance TPA

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Here’s why customers like Abhinav love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 5,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

You can book a FREE consultation with us. Slots are filling up quickly, so be sure to book a call now or chat with us on WhatsApp!

Ditto’s Take: TPA vs. In-House Claims

At Ditto, we closely analyze how insurers handle claims. While all insurers use TPAs to some extent, especially for managing group insurance products (like corporate policies), we recommend opting for insurers with in-house claim settlement teams for retail health insurance.

An in-house team usually means a faster, more transparent, and customer-centric experience because the insurer controls the entire process directly.

Popular Insurers with In-House Claims

If you want to avoid a health insurance TPA for retail policies, consider insurers like:

- HDFC ERGO

- Care Health Insurance

- Aditya Birla Health Insurance

- Niva Bupa

- ICICI Lombard

Pro Tip: To check if your insurer uses a health insurance TPA and for which products, look for the NL 48 Form in their annual public disclosures. This form details their quantitative and qualitative parameters regarding health services. It also shows both “In-house” and “Services rendered by TPA” entries.

Frequently Asked Questions

Last updated on: