Quick Overview

A medical emergency shouldn’t force you to dip into your savings or take on debt, but for many families, that’s precisely what happens due to inadequate health insurance. At Ditto, we’ve gone through Tata AIG’s policy documents, brochures, and fine print to curate this guide.

Here, we break down Tata AIG Health Insurance Plans for Family, explain what they cover (and what they don’t), and help you decide whether they deserve a place in your financial plan for 2026.

Eligibility Criteria for Tata AIG Health Insurance Plans for Family

Minimum entry age:

Adults can enter from 18 years, while children are covered from 91 days onwards when insured with at least one adult.

Maximum entry age:

Entry is generally allowed up to 65, though some plans have no maximum age.

Policy term:

Available for 1, 2, or 3 years, with longer tenures often providing premium discounts.

Note: Eligibility requirements can vary by plan, so it’s essential to check the specifics before buying.

List of Tata AIG Health Insurance Plans for Family

This plan is suitable for families looking for standard hospitalisation coverage with essential benefits.

- Sum Insured: Available from ₹3 lakh to ₹20 lakh, depending on the variant chosen.

- Hospitalisation Coverage: Covers inpatient hospitalisation along with 540+ daycare procedures.

- Restoration Benefit: Offers 100% restoration of the sum insured once the sum insured is exhausted.

- No-Claim Bonus: Provides a 50% increase in sum insured per claim-free year, up to a maximum of 100%.

- Waiting Periods & Preventive Care: Pre-existing diseases are covered after a 3-year waiting period, and health check-ups are available once every 2 years.

Note: OPD and maternity benefits are not included, and the premium is relatively higher for the features offered.

This is a more comprehensive family health insurance plan with wider coverage and value-added benefits.

- Sum Insured: Starts from ₹5 lakh and goes up to ₹3 crore, making it suitable for higher coverage needs.

- Hospitalisation & Daycare: Covers hospitalisation and daycare treatments as per policy definitions.

- Restoration & Bonus: Includes 100% restoration of the sum insured and a 50% no-claim bonus per year (up to 100%).

- Shorter Waiting Period: Pre-existing diseases are covered after just 2 years.

- Enhanced Benefits: Offers annual health check-ups, OPD coverage (limits linked to sum insured), and maternity benefits up to ₹50k- ₹1 Lakh (depending on the tier) after a 3-year waiting period.

This is a flexible and feature-rich option.

- Wide Sum Insured Range: ₹5 lakh to ₹3 crore with multi-year policy options.

- Restore Infinity Plus: Unlimited restoration of the sum insured during the policy year.

- Bonus and Add-ons: Includes a cumulative bonus and a comprehensive set of add-ons and riders.

- Optional Covers: OPD care, maternity benefits (including newborn vaccinations), daily cash benefits, and mental well-being or women’s health riders.

This is a simplified, budget-friendly plan that provides essential hospitalisation coverage without adding financial strain.

- Coverage Benefits: Offers cashless treatment for hospitalisation and core medical expenses through Tata AIG’s network of hospitals across India.

- Key Features: Covers essential inpatient costs, including pre- and post-hospitalisation expenses (subject to policy terms), with easy policy issuance and renewal.

- Copayment: There’s a “Valued Provider: Pan India” network, where copayments may apply. 20% copayment if your entry age is 61+ and 30% if the treatment is outside the “valued provider” network.

- Best For: Budget-conscious policyholders or families seeking basic yet reliable hospitalisation cover.

5) Tata AIG MediCare Plus (Super Top-Up)

This plan is ideal for families or individuals looking to enhance their existing health insurance coverage without paying high premiums for a standalone high-sum policy.

- Sum Insured: Offers high coverage limits (commonly up to ₹1 crore) at affordable premiums.

- Coverage Scope: Covers hospitalisation expenses, including room rent, ICU charges, organ donor expenses, domiciliary treatment, AYUSH treatment, ambulance charges, and more.

- Benefits: Includes cumulative bonus (up to 100% for claim-free years), consumables benefit, and cashless claims at a wide network of hospitals.

- Best For: Those with a base health plan who want higher financial protection without switching to a costly standalone policy.

Premium Comparison of Tata AIG Health Insurance Plans for Family

We’ve considered different profiles (non-smokers with no pre-existing conditions), living in a tier-1 city like Delhi, and insured for 15 lakhs. We’ve also added the consumables and preventive annual health check-up add-ons to the MediCare Select plan for a fair comparison.

Note: Premiums are subject to underwriting; please refer to the insurer’s official website for the most up-to-date premiums.

Inclusions and Exclusions of Tata AIG Health Insurance Plans for Family

What’s Typically Covered

As indicated in the Tata AIG plans list, these typically include inpatient hospitalisation expenses, pre-hospitalisation and post-hospitalisation costs, daycare procedures, OPD costs, organ donor medical costs, and AYUSH treatments, among other things.

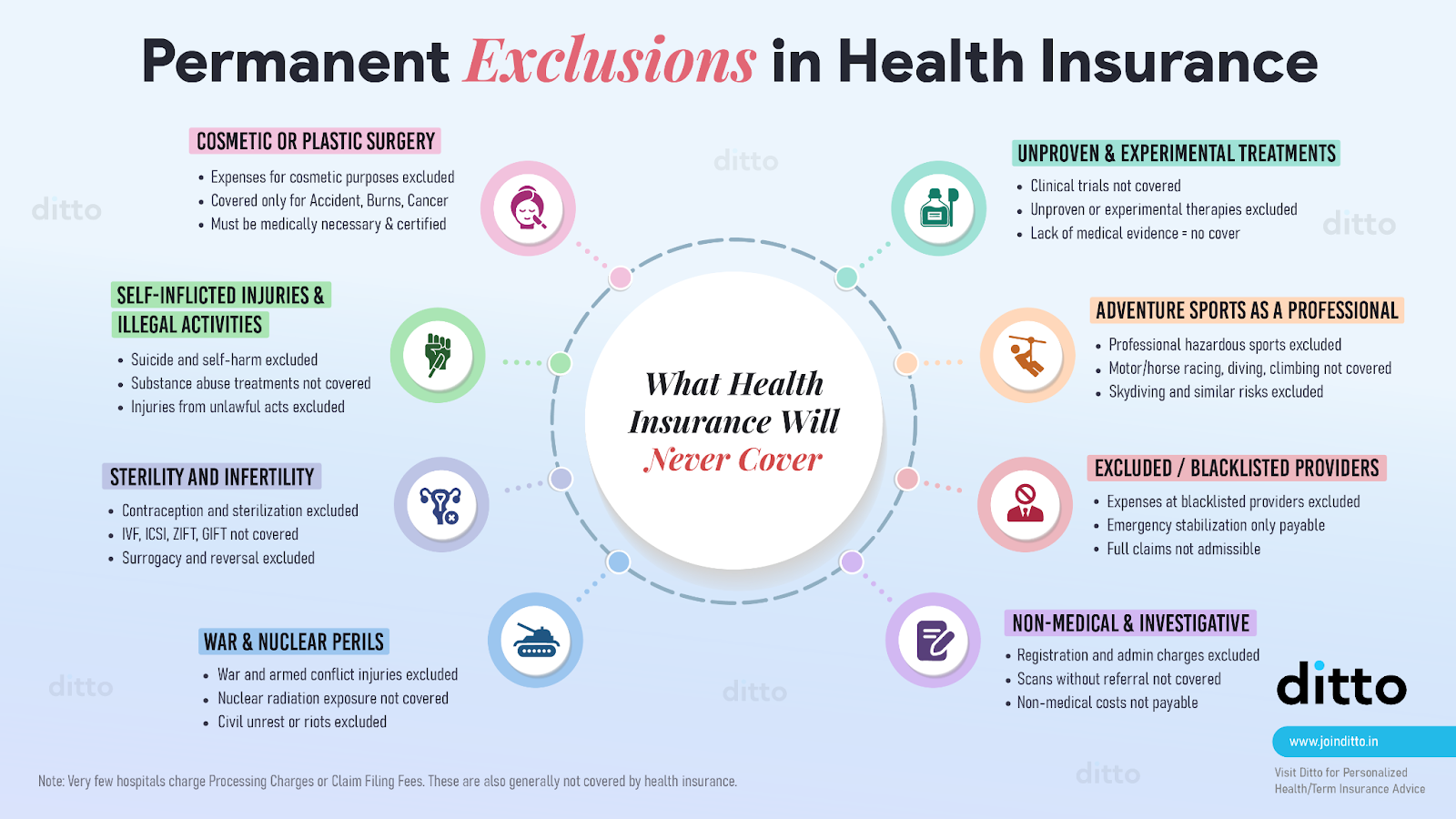

What’s Typically Not Covered

Tata AIG has exclusions that are standard across the health insurance industry. The attached infographic below breaks them down:

Note: Additional exclusions vary from policy to policy.

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Rajan below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call or chat with us on WhatsApp now!

Conclusion

Tata AIG offers comprehensive health insurance plans for your family. However, when choosing a health insurance plan, insurers' performance on key metrics is equally essential. Based on claim settlement ratio, incurred claim ratio, solvency ratio, complaint volume, and business volumes, there are better insurers in the market. For example, HDFC Ergo, Aditya Birla, and Bajaj General. For more details, you can check out our review of Tata AIG Health Insurance.

Full Disclosure: Tata AIG is not a partner-insurer of Ditto. The above-mentioned information is taken from policy brochures, documents, the insurer’s website, and publicly available data.

Frequently Asked Questions

Last updated on: