Swavlamban Health Insurance was a pilot government scheme implemented in 2015-16 under the erstwhile Trust Fund for Empowerment of Persons with Disabilities, by the Department of Empowerment of Persons with Disabilities under the Ministry of Social Justice & Empowerment.

It offered a health insurance cover of ₹2 lakh per family annually, including the person with disability (PwD) and up to three family members. The scheme was implemented through New India Assurance Company Limited, with an annual premium of ₹3,100 + applicable taxes per beneficiary. Only 10% of this premium was collected from beneficiaries, while the remaining 90% was funded by the Trust Fund.

However, Swavlamban was discontinued when the government launched Ayushman Bharat – PMJAY, which covers persons with disabilities as well. Despite appeals to revive it, the government decided not to do so.

Looking for inclusive health insurance? Compare top PwD plans with expert advice from Ditto – no spam, just honest guidance

What is the eligibility criteria of Swavlamban Health Insurance?

- Individuals must be Persons with Disabilities (PwDs) certified by the competent authority under the Rights of Persons with Disabilities (RPWD) Act, 2016.

- The policy covered the entire family of the PwD (four members total including the PwD).

- There was no specific income limit mentioned, though most implementations focused on economically vulnerable PwDs, especially BPL families.

- Beneficiaries must be Indian citizens with a valid disability certificate.

- There were no pre-insurance medical tests required.

- The scheme was implemented in 21 States and Union Territories in India, including Kerala, Delhi, Maharashtra, Tamil Nadu, etc.

What is the application process for Swavlamban Health Insurance?

- The PwD had to obtain a valid disability certificate issued by the competent authority under the RPWD Act.

- The implementing agency helped collect the application forms and supporting documents, such as:

- Disability Certificate.

- Aadhaar or other government-issued photo ID.

- Proof of residence.

- The filled application form, along with the required documents, was submitted to the implementing agency designated by the government.

- The implementing agency collected 10% of the annual premium from the beneficiary.

- The remaining premium (90%) was paid by the Government via the Trust Fund.

- Once accepted, a Swavlamban Health Insurance policy was issued underwritten by New India Assurance.

Other Government Health Insurance Schemes for People with Disabilities

Apart from Swavlamban Health Insurance, several other government-backed schemes provide health coverage and financial support for Persons with Disabilities (PwDs). These initiatives are designed to reduce the healthcare burden, improve access to treatment, and support independent living.

1. PM-JAY (Ayushman Bharat – National Health Protection Mission)

- Coverage: Provides up to ₹5 lakh per family annually.

- Eligibility: Based on the Socio-Economic Caste Census (SECC) 2011 data.

- Families with a “disabled member and no able-bodied adult” are automatically included.

- Benefits:

- Covers hospitalization expenses for serious illnesses.

- Includes daycare procedures (that don’t require overnight hospitalization).

- Pre- and post-hospitalization costs are covered for 3 and 15 days, respectively.

- Impact: Acts as a safety net for families with disabled members, especially those below the poverty line.

2. Niramaya Health Insurance Scheme

- Launched by: The National Trust under the Ministry of Social Justice & Empowerment.

- Target group: Individuals with developmental disabilities such as Autism, Cerebral Palsy, Intellectual Disabilities, and Multiple Disabilities.

- Coverage: Up to ₹1,00,000 annually, offered on a reimbursement basis.

- What it covers:

- Outpatient (OPD) treatments.

- Corrective surgeries.

- Ongoing therapies (like physiotherapy or speech therapy).

- AYUSH treatments.

- Transportation costs related to medical care.

- Why it matters: Unlike many schemes that only focus on hospitalization, Niramaya also covers long-term therapies and outpatient support, which are essential for PwDs.

3. DISHA Scheme

- Purpose: Provides financial support to PwDs aged 0-10 years for both health-related needs and employability.

- Coverage includes:

- Assistive devices like hearing aids, prosthetics, and wheelchairs.

- Vocational training to help PwDs develop work-ready skills.

- Benefit: Reduces the financial burden of expensive assistive aids while also improving the individual’s chance of leading an independent life.

4. Samarth Scheme

- Focus: Enhancing the independent living and employability of PwDs.

- Coverage includes:

- Skill development training (computers, tailoring, handicrafts, etc.).

- Vocational training for sustainable livelihoods.

- Impact: Goes beyond healthcare by focusing on rehabilitation and inclusion of PwDs into the workforce.

5. Gharaunda Scheme

- Objective: Supports families of PwDs by making homes safer and more accessible.

- Coverage includes:

- Financial assistance for home modifications like ramps, grab bars, or accessible toilets.

- Improves mobility and independence within the home environment.

- Benefit: Reduces the reliance on caregivers by ensuring that the home is PwD-friendly.

6. Vikaas Scheme

- Aim: Focuses on economic empowerment of PwDs.

- Coverage includes:

- Vocational training in industry-relevant skills.

- Employment-linked courses tailored to PwDs.

- Impact: Helps PwDs not just survive, but thrive — by increasing their chances of stable income and independence.

Together, these schemes ensure that healthcare for PwDs is not just about covering hospital bills, but also about rehabilitation, assistive support, and long-term empowerment.

Health Insurance Plans from Private Insurers for People with PwDs

PWD-Specific Health Insurance Plans

These plans are specifically designed for persons with disabilities (PwDs), often covering corrective surgeries, assistive devices, and therapies.Examples include:

- HDFC ERGO Equi Health Insurance

- Pre-existing disabilities covered after 24 months.

- AYUSH up to SI, ICU cover, cataract cover, co-pay options.

- Care Saksham by Care Health Insurance

- Covers modern treatments, AYUSH, and emergency ambulance charges.

- Star Health Special Care Gold

- No pre-policy medical tests, cataract and AYUSH coverage, co-pay waiver with extra premium.

Comprehensive Health Insurance Plans

There are also standard individual/family floater plans that accept eligible PwDs, provided their disability is less than 50%, stable, and without major comorbidities. These include:

- Niva Bupa ReAssure 2.0

- HDFC Ergo Optima Secure

- Tata AIG MediCare Premier

- Aditya Birla Activ One Max

- Star Super Star

Note: IRDAI mandates that every insurer must offer at least one policy tailored for PwDs, HIV/AIDS, and mental illness, with fair underwriting practices.

Why Consider Ditto for Health Insurance?

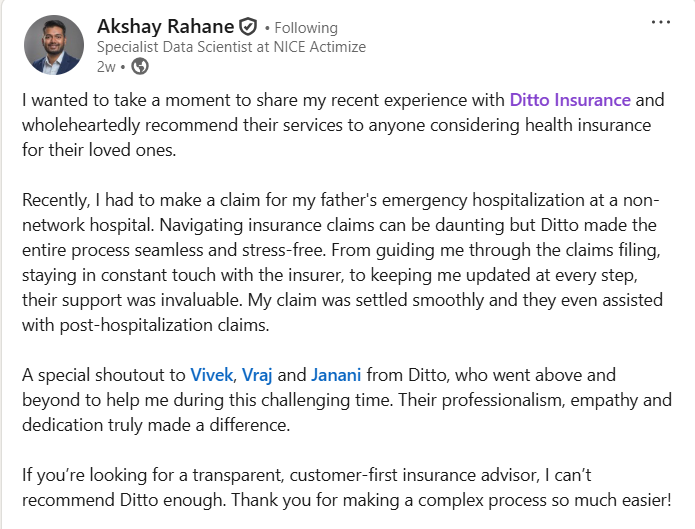

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right health insurance policy. Here’s why customers like Akshay love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

Swavlamban Health Insurance was a critical government scheme designed to provide health coverage to economically vulnerable Persons with Disabilities. Although discontinued in favor of the broader PMJAY, other government schemes like Niramaya, DISHA, Vikaas, Samarth, and Gharaunda, along with private PWD-specific insurance plans, continue to support PwDs in India.

With IRDAI’s progressive regulation ensuring no blanket denial for persons with disabilities, the insurance landscape is gradually becoming more inclusive, though gaps still remain, particularly in outpatient care and assistive device coverage.

Frequently Asked Questions (FAQs)

Does Swavlamban Health Insurance cover pre-existing medical conditions?

Yes, it covered pre-existing disabilities from day one, without requiring pre-insurance medical tests.

Can Swavlamban Health Insurance be renewed after the policy period ends?

The scheme was terminated and is no longer available. PwDs are advised to apply for alternative government schemes or private plans.

Can I buy multiple disability health insurance policies at the same time?

Yes, but the total claim payout across all policies cannot exceed the actual medical expense.

Can I buy health insurance after suffering a disability due to an accident?

Yes, but insurers will evaluate your condition via underwriting. PWD-specific policies or government schemes are recommended if private insurers impose restrictions.

What if my disability is more than 50% or involves multiple comorbidities?

You should consider PWD-specific health insurance plans or government schemes like Niramaya, which are designed to provide coverage without strict exclusion clauses.

Last updated on: