What is Supplemental Health Insurance?

Supplemental health insurance provides extra coverage alongside your main health insurance plan. It helps you cover costs that your standard policy does not pay for. In India, the term "supplemental insurance" is used interchangeably with riders, as standalone policies are less common. While all supplemental policies work independently, riders are attached to an existing policy.

Introduction

Even with health insurance, most Indians still pay a large share of medical costs. In 2021-22, families still spent roughly 4 out of 10 rupees out of pocket for healthcare expenses. Despite the steady decline of out-of-pocket expenditure, chronic and critical illnesses continue to push many to spend beyond what standard policies fully cover.

At Ditto, we’ve seen firsthand how the right supplemental health insurance policies can help families overcome such gaps.

In this guide, we’ll help you know:

- How does supplemental health insurance work?

- Is supplemental health insurance worth buying?

- When is it smarter to skip supplemental health insurance?

Still confused whether supplemental coverage is right for you? Book a free call with Ditto for further assistance.

How Does Supplemental Health Insurance Work?

Coordination with Primary Insurance

When a medical expense occurs, your primary insurance pays first as per policy limits. Later, supplemental health insurance provides additional payouts to cover remaining out-of-pocket costs.

Benefit Payout

Supplemental health insurance benefits are paid either as reimbursements for covered costs or as lump-sum cash payments upon specific events, such as hospitalization or diagnosis of a critical illness.

Claim Process

You generally submit the relevant medical documents, primary insurance claim details, and policy documents to the insurer for claims. A few plans from insurers like HDFC ERGO and Care may also offer direct cashless settlements for particular treatments.

Quick Note: You can also hold multiple indemnity-based plans as supplemental policies in cash sum insured are exhausted, but it can be an expensive affair.

What Does Supplemental Health Insurance Cover?

Supplemental insurance generally covers copayments, deductibles, and certain treatments or services excluded from regular coverage, like maternity or OPD expenses. The financial support is generally for out-of-pocket medical expenses, hospital stays, accidents, and critical illnesses, and often covers non-medical costs such as travel and lodging during treatment.

Types of Supplemental Health Insurance

Let’s start by giving you a small glimpse of India’s insurance market, which runs on two building blocks:

- Indemnity policies that involve reimbursing hospital bills up to your sum insured (base plans, top-ups, or super top-ups).

- Benefit (fixed-payout) policies, which pay a lump sum on a defined trigger (e.g., critical illness, hospital cash, or personal accident).

IRDAI uses both categories under specific rules, like grace period/renewal or moratorium. Your policy must ship with a Customer Information Sheet (CIS) that lists its type (indemnity/benefit), sum insured, exclusions, sub-limits, deductibles, waiting periods, portability, and moratorium info, including any claims/ombudsman contacts.

Now, the “supplemental” menu Indians actually buy includes the following:

Top-ups and Super Top-ups (Indemnity)

Purpose: Raise the coverage above a deductible limit.

Working Rule of Thumb: A top-up plan applies the deductible per claim, while a super top-up plan applies the deductible on an aggregate basis across the policy year.

Where it Shines: Works best with employer cover. Set the deductible close to your corporate sum insured so the super top-up activates only for large medical expenses. Alternatively, keep a base plan of 10–15L and add a super top-up for black swan events (an unexpected event that may cause massive financial loss).

Examples: Care Supreme + Care Supreme Enhance Super and Aditya Birla Activ One Max+ Super Health Plus Super Top-up plans.

Critical Illness (Benefit)

Purpose: Lump-sum on diagnosis of listed illnesses (e.g., cancer or stroke).

Working Rule of Thumb: IRDAI standardizes many CI definitions and updates them (e.g., 2019/2022 revisions) to reduce interpretive fights at claim time (refer to the Master Circular for more details).

Where it Shines: The payout can be used to cover non-medical expenses or income gaps during treatment.

Examples: Care Assure and HDFC ERGO CI Platinum

Hospital Cash (Benefit)

Purpose: Fixed per-day cash during admissible hospitalisation (subject to min. hours/max days as per product).

Where it Shines: It is often treated as a non-medical buffer to cover attendant costs, travel, childcare, or lost income.

Examples: HDFC ERGO Optima Secure + Hospital cash rider or Star Hospital cash plan (standalone)

Personal Accident (Benefit)

Purpose: Lump-sum for accidental death/disablement; sometimes weekly income for temporary total disablement.

Working Rule of Thumb: Pairs well with term life to plug accident-specific shocks.

Examples: HDFC Ergo Accident Protection Plan and Aditya Birla Active Secure

Riders/Add-ons (on an Indemnity basis)

Purpose: Extend or enhance the base policy with extra coverage, such as critical illness protection, hospital cash, accidental death, or waiver of premium.

Working Rule of Thumb: Choose riders that cover gaps in your core policy without overloading on overlapping benefits.

Examples: Waiver of premium rider, Accidental Death Benefit Rider, or Terminal Illness rider

Benefits of Supplemental Health Insurance

Covers Gaps in Standard Policies

Financial Protection for Families

Flexibility and Customisation

Peace of Mind

Limitations of Supplemental Health Insurance

While supplemental health insurance is beneficial, it has certain limitations, such as:

- Coverage is limited to specific conditions or circumstances.

- Policies may have waiting periods before benefits become available.

- Premiums vary based on age, medical history, and type of plan.

- They should not be seen as a replacement for comprehensive health insurance but as an add-on.

How to Choose the Right Supplemental Health Insurance (Ditto’s Take)

Here’s how to decide on what works best for you:

Step 1: Start with a Comprehensive Base Plan

Always begin by securing a comprehensive indemnity-based health plan, your primary defense against major hospitalisation costs. Your base plan should ideally:

- Have no room rent limits, disease-specific caps, or co-pay clauses.

- Offer unlimited restoration of the sum insured (for both unrelated and related claims).

- Include consumables cover to avoid unexpected non-payable costs.

- Provide a high No Claim Bonus (NCB) or loyalty bonus for long-term value.

- Offer a sufficiently large sum insured (₹25–50 Lakhs). If cost is a concern, consider a structured plan (₹10 L base + 40–90 L Super Top-Up).

Note: This single step can cover 80% or more of your medical cost risks, including worst-case scenarios.

Step 2: Identify Additional Needs

Once your base plan is in place, assess secondary or lifestyle-specific needs such as:

- Outpatient (OPD) coverage

- Maternity and newborn benefits

- Disability income protection

- Critical illness (CI) payouts

Step 3: Choose the Smartest Way to Add Each Cover

Maternity, OPD & Hospital Cash

- Best added as riders or add-ons within your base health plan.

- Standalone options are often limited, costly, and involve multiple claim processes.

- Riders provide convenience, continuity, and cost-efficiency.

Disability Coverage

- More cost-effective as a rider to your term life plan or via a standalone personal accident policy.

- Covers death as well as partial/total disability at lower premiums than health add-ons.

Critical Illness (CI) Cover

CI riders are usually the most economical, with fixed premiums for the policy duration. Meanwhile, standalone CI policies are worth considering if:

- You don’t yet have a substantial emergency fund, or

- There’s a family history of lifestyle diseases like cancer or cardiac illness.

Step 4: Optimize Without Overlapping

Each cover should address a specific risk, not duplicate another.

- Base Indemnity Plan: Covers major hospitalization expenses.

- Critical Illness and Disability Plans: Replace income during recovery or in case of long-term health setbacks.

- OPD and Maternity Riders: Take care of smaller, routine, or expected healthcare expenses.

Think of it as building a layered shield: high-value protection at the core, lifestyle conveniences on the surface.

Why Choose Ditto for Your Health Insurance?

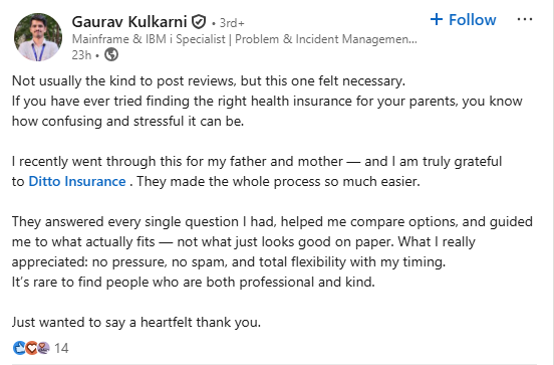

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Gaurav below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 10,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Is Supplemental Health Insurance Worth It?

Supplemental policies can help you overcome all coverage gaps, which ensures that you and your family are protected no matter what comes your way. While they offer a more comprehensive coverage than your base policy, it's always recommended to analyze your medical and financial needs thoroughly before proceeding with a plan.

FAQs

When can I buy supplemental Insurance?

You can buy supplemental health insurance at any time through an insurance company or during specific enrollment periods if offered by your employer.

What is typically covered by supplemental insurance?

Supplemental health insurance covers specific medical events, expenses, or benefits that your base health insurance does not include. It provides targeted financial protection for accidents, illnesses, hospitalization, dental or vision care, maternity, or international emergencies.

Who should consider buying supplemental health insurance?

Supplemental health insurance is ideal for families, senior citizens, individuals with high-risk jobs, and NRIs who need international coverage. It’s also a smart choice for getting financial protection against critical illnesses or accidents.

Last updated on: