| What is 1 Crore Health Insurance Plan? A ₹1 crore health insurance plan is a policy that covers your medical expenses up to ₹1 crore in a year. This means if you ever face a major health emergency like advanced cancer treatment, organ transplant, or a long ICU stay, your insurer will pay the bills (up to ₹1 crore), so you don’t have to drain your savings. It’s designed for people who want the highest possible financial protection against rising medical costs, especially in private hospitals or for treatments abroad. |

Today, medical costs are skyrocketing, often leaving families financially vulnerable even with health insurance. With a 14-15% medical inflation raising the cost of surgeries, hospitalisation, and advanced treatments every year, a ₹1 crore health insurance plan offers expansive coverage and peace of mind. That said, such high coverage often comes with a hefty premium.

A smarter, more affordable approach for many, and one we at Ditto often recommend — is to combine a base health insurance plan with a super top-up. This way, you can secure ₹1 crore coverage and enjoy broader protection at just a fraction of the cost. In this blog, we’ll cover the standalone ₹1 crore policies that make Ditto’s Cut, cost-effective combos, when such plans make sense, its limitations, and Ditto’s overall take.

Not sure if you should opt for 1 crore health insurance cover? Talk to Ditto’s expert advisors today and get unbiased, personalised guidance - absolutely free.

1 Crore Health Insurance Plans That Make Ditto’s Cut

| Before we discuss the list, here’s how we decide what plans to feature. At Ditto, every health plan goes through our six-point evaluation framework. It doesn’t mean these are the only good plans, but that they stand out after being scored across all six pillars. You can learn more about how we evaluate health insurance plans here. |

The below-mentioned plans are our top picks because they come with no major restrictions, strong bonuses and perks, reliable insurer performance, and an overall solid cost-to-benefit ratio.

| Best Health Insurance Plan | Room Rent Restrictions | Co-payment | Disease-wise Sub-limits | Bonus / Perks | Unique Benefits |

|---|---|---|---|---|---|

| HDFC ERGO Optima Secure | No restrictions | No | No | 50% per year (up to 100%) | Secure Benefit: doubles sum insured from day one; unlimited restoration add-on; extensive cashless network |

| Care Supreme | No restrictions | No | No | 100% per year (up to 500%); Cumulative Bonus Super (up to 600%) | Unlimited recharge; e-consultations; wellness rewards; modern treatment cover |

| Aditya Birla Activ One Max | No restrictions | No | No | HealthReturns up to 100% premium back | Base SI up to ₹6 Cr; unlimited restoration; OPD teleconsult add-on |

| Niva Bupa ReAssure 2.0 (Titanium+) | No restrictions | No | No | Booster+ can multiply SI up to 11x | Lock the Clock (premiums frozen till first claim); ReAssure Forever = lifetime unlimited restoration |

| ICICI Lombard Elevate | Single Private Room (add-on removes) | No | No | 20% per year (up to 100%) | Oocyte donor coverage for assisted reproduction; Infinite Care add-on = unlimited coverage for 1 claim; inflation-adjusted SI add-on |

Ditto Verdict – Who Should Pick What?

- HDFC ERGO Optima Secure → Best for those who want immediate high cover (₹2 Cr from day one).

- Care Supreme → Best for families needing continuous cover with unlimited recharge, comprehensive bonus and options to reduce waiting periods.

- Aditya Birla Activ One Max → Best for HNIs or those wanting ultra-high SI (₹6 Cr).

- Niva Bupa ReAssure 2.0 → Best for long-term planners who want premiums locked early + lifetime unlimited restoration.

- ICICI Lombard Elevate → Best for customisation (add-ons like Infinite Care + inflation-adjusted SI).

What Sets ₹1 Crore Health Insurance Apart From Lower Coverage Plans?

A ₹1 crore health insurance plan stands out from average ₹10–25 lakh policies because it offers a much higher sum insured, broader coverage, and superior flexibility in benefits. Here’s what makes it unique:

1. Higher Coverage Limit

₹1 crore health insurance plans provide 4–10x the protection of standard ₹10–25 lakh covers, which is critical for high-cost treatments like cancer, organ transplants, cardiac surgeries, or long ICU stays.

- Example: ICICI Lombard Elevate offers an “Infinite Sum Insured” upgrade with options like Critical Illness cover and Power Booster (100% bonus).

2. Broader Coverage & Benefits

Beyond hospitalisation, these plans often include OPD care, maternity, wellness, and faster PED coverage through riders.

- Example: HDFC ERGO Optima Secure offers an "Optima Wellbeing" OPD add-on, which provides unlimited tele and in-person doctor consultations, online psychology counseling, diet and nutrition consultations, fitness sessions, and discounts on diagnostics and medicines.

3. Better Claim Support and Network Hospitals

Insurers offering ₹1 crore plans usually have wider cashless hospital tie-ups, including premium multispecialty centres and sometimes overseas hospitals.

- Example: Care Advantage (₹1 Cr) with the add-on Protect Plus with Global Cover not only covers advanced treatments but also extends access to overseas hospitalisation (planned and emergency), donor and ambulance support, and repatriation.

HDFC ERGO Optima Secure Global / Global Plus extend cover for both planned and emergency treatments abroad, with cashless support sometimes possible if the hospital has a tie-up with their overseas TPA (Third-Party Administrator).

4. Additional Riders and Add-ons

₹1 crore health insurance plans usually allow for richer add-ons like global treatment riders, wellness programs, and options to reduce waiting periods for pre-existing diseases.

- Example: Niva Bupa Aspire’s Borderless add-on for global care, or Care Supreme’s Instant Cover Plus that cuts waiting for diabetes and hypertension to just 30 days.

5. Peace of Mind and Long-Term Security

High-end plans are designed to handle costly modern treatments and rising medical inflation without financial strain.

- Example: Plans like Aditya Birla Activ One Max (with unlimited restoration and HealthReturns) and Care Supreme (with up to 600% cumulative bonus) ensure your cover keeps growing and replenishing, providing long-term protection even as medical costs rise.

In short, ₹1 crore health insurance plans deliver superior protection, flexibility, and peace of mind compared to ₹10–25 lakh policies, making them a strong choice for anyone who wants robust long-term health security.

Affordable 1 Crore Health Insurance Plans

There are two practical ways to get a ₹1 crore cover. The first is to buy a dedicated ₹1 crore base plan (like the ones listed above), which gives you comprehensive benefits upfront. The second, cost-effective option, is to combine a smaller base plan with a super top-up, which keeps premiums lighter while still giving you access to ₹1 crore coverage.

Note: A strong base plan with high sum insured, unlimited restoration, and bonus often makes super top-ups unnecessary. However, super top-ups can still be useful for added financial protection. Buying from the same insurer as your base plan simplifies claims, though it’s not mandatory.

To give you a clear picture, here’s a comparison of annual premiums across some of the leading ₹1 crore health insurance plans

Premiums for ₹1 Crore Health Insurance Plans

Note: Premiums including GST, for a couple aged 35 & 33 years, Sum Insured ₹ 1 Cr

| Insurer and Plan | Premiums |

|---|---|

| HDFC Optima Secure | ₹39,003 |

| Care Supreme | ₹43,811 |

| Aditya Birla Activ One Max | ₹32,463 |

| Niva Bupa Reassure 2.0 Titanium+ | ₹42,524 |

Now, let’s look at some of the most popular combo plans that offer ₹1 crore coverage without breaking the bank.

1. Niva Bupa ReAssure 2.0 Titanium+ (₹10L) + Niva Bupa Health Recharge (₹90L)

This combo is often marketed as Max Super Saver on insurance platforms and is among the most cost-effective ways to get ₹1 Cr coverage, with ReAssure 2.0 being a strong, feature-rich base policy. The base plan offers no room rent caps, “ReAssure Forever” (unlimited restoration for life), and Booster+ (carry-forward of unused cover), along with coverage for advanced treatments like robotic surgeries up to the full sum insured. Annual health check-ups from day one further add value.

Niva Bupa ReAssure 2.0 Titanium+ (₹10L) + Health Recharge Super Top-up (₹90L) = ₹1 Cr coverage | Premium: ₹18,322 + ₹1,130 = ₹19,452 (1 year, 2 adults – 35 & 33 yrs, Delhi)

- Drawbacks: The Health Recharge Super Top-up isn’t as comprehensive as the base plan: it lacks some features and comes with room-type restrictions (details here). Post rebrand from Max Bupa to Niva Bupa, complaint volumes have seen an increase (Niva Bupa Public Disclosures, Mar 2025 – page 48).

2. Care Supreme (₹10L) + Care Supreme Enhance Super Top-up (₹90L)This combo delivers strong protection with no room rent limits and unlimited restoration across both policies, features that add real value at this high cover level. The STU further strengthens the package with a cumulative loyalty bonus (10% per claim-free year, up to 100%) and a mandatory add-on that removes room rent caps, something rare in super top-ups.

Care Supreme (₹10L) + Care Supreme Enhance STU (₹90L) = ₹1 Cr coverage | Premium: ₹19,204 + ₹3,142= ₹22, 346 (1 year, 2 adults – 35 & 33 yrs, Delhi)

Opting for the combo (₹22,346) costs nearly 50% less than the standalone Care Supreme ₹1 crore plan (₹43,811).

- Drawbacks: The STU only activates after a relatively high deductible (₹5–15 lakh), which may not suit everyone. Maternity and doctor consultations aren’t included, and free health check-ups are missing.

3. Aditya Birla Activ One Max (₹10L) + Super Health Plus Super Top-up (₹90L)

This is a solid ₹1 Cr combo for budget-conscious buyers. The base plan is comprehensive, while the Super Top-up stands out because it doesn’t impose room-type restrictions and even offers the rare option to remove deductibles.

Aditya Birla Activ One Max (₹10L) + Super Health Plus Super Top-up (₹90L) = ₹1 Cr coverage | Premium: ₹14,780 + ₹4,229 = ₹19, 009 (1 year, 2 adults – 35 & 33 yrs, Delhi)

The combo (₹19,009) is about 40% cheaper than the standalone Aditya Birla Activ One Max ₹1 crore plan (₹32,463).

- Drawbacks: Aditya Birla is a reliable insurer, but has less of a track record since it came into existence in 2016 & complaint volumes are slightly on the higher side compared to peers. (refer to page 50 of the policy wording)

While some ₹1 crore health insurance plans do include global treatment options, the terms, limits, and exclusions can get tricky. If international coverage is a priority for you, we’ve broken down the best plans, their features, and key caveats in this detailed guide.

When Does a 1 Crore Health Insurance Plan Make Sense?

A ₹1 crore health insurance plan isn’t for everyone. It’s designed for situations where standard ₹10–25 lakh covers may fall short. The need usually arises when healthcare costs, lifestyle preferences, or financial goals demand stronger protection. Here are some scenarios where such a plan can make sense:

- High Medical Inflation Exposure: Critical treatments like cancer care, organ transplants, or extended ICU stays in private hospitals can easily cross ₹30–40 lakh, and in many cases, even exceed ₹50–70 lakh.For instance, a liver or heart transplant can cost upwards of ₹20–35 lakh, while advanced cancer therapies like immunotherapy may add ₹10–30 lakh annually. This makes a ₹1 crore health insurance cover essential to safeguard long-term savings.

- Global Treatment Aspirations: Those who want access to advanced or rare treatments abroad benefit from ₹1 crore plans with international coverage options, like HDFC ERGO Optima Secure Global, which covers planned and emergency treatments worldwide.

- HNIs and Professionals: For high net-worth individuals or professionals with significant financial bandwidth, a ₹1 crore health insurance plan safeguards long-term financial plans by covering major medical expenses without disrupting other investments.

Limitations & Exclusions Specific to 1 Crore Plans

Even high-value policies come with caveats:

- High & Rising Premiums: ₹1 crore health insurance plans start with significantly higher premiums than standard covers. Beyond the initial cost, policyholders must also account for sharp renewal hikes, driven both by age-band increases and medical inflation. Over the long run, this can make such plans considerably more expensive than expected.

- International Coverage Caps: While some insurers may tie up with overseas TPAs, the hospital networks and agreement details remain opaque, and in practice claims often end up being on a reimbursement basis. This poses a practical challenge as arranging large sums in foreign currency upfront may not be feasible. For short trips, travel insurance may be more practical, while those relocating abroad should consider a local health insurance policy in the destination country.

HDFC ERGO Optima Secure Global provides worldwide hospitalisation coverage in India and emergency overseas treatments

- Sub-limits & Room Rent Restrictions: Super top-up plans commonly impose room rent limits. For instance, the Niva Bupa Health Recharge super top-up plan has room rent restrictions despite offering a high sum insured, a typical caveat with super top-ups.

Even comprehensive base ₹1 crore plans can carry such fine print. For example, ICICI Elevate restricts coverage to a single private room unless you opt for an add-on to upgrade to “any room” coverage. Without this add-on, policyholders may face significant out-of-pocket costs despite having a high cover.

If you’re wondering whether ₹1 crore is too much and want to weigh it against a lower cover, here’s a detailed guide on ₹50 Lakh Health Insurance that might help you decide.

Why Approach Ditto for Your Health Insurance Plan?

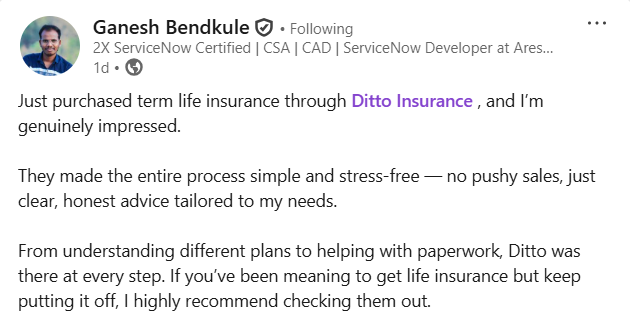

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Ganesh below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Should You Buy a 1 Crore Health Insurance Plan: Ditto’s Take

A ₹1 Cr plan is not for everyone. But if you want complete peace of mind, especially considering medical inflation and the possibility of international care, it’s worth exploring.

- Who can buy: HNIs, NRIs visiting India, globally mobile professionals.

Ditto’s verdict: A ₹1 crore health insurance plan is useful if you can afford the premium, but for most, a well-structured ₹15–25 lakh plan is sufficient. Look for unlimited restoration, >100% cumulative bonus (even after claims), and full coverage without hidden caps. A ₹1 crore cover makes sense based on affordability, family size, city, hospital preference, age, and health. Ensure the plan has no co-pay, room rent/disease limits, and covers consumables for true protection.

If you’re still unsure about which plan to pick, you can check out our detailed guide on how to choose the right health insurance. Or better yet, speak to a Ditto advisor today. We’ll help you choose the right coverage based on your needs, not just the number on the policy.

FAQs

Is a ₹1 crore health insurance plan really worth it?

Not for everyone. For most people, a well-structured ₹15–25 lakh plan with unlimited restoration is usually sufficient. A ₹1 crore plan makes sense if you want global treatment options, anticipate high medical costs, or have the financial bandwidth to afford higher premiums.

Is there a cheaper way to get ₹1 crore coverage?

Yes. Instead of a standalone ₹1 crore plan, you can pair a smaller base plan with a super top-up. This combo costs much less, though the super top-up only kicks in after a deductible.

Who should consider buying a ₹1 crore health insurance plan?

It’s best suited for HNIs, globally mobile professionals, NRIs visiting India, families who prefer treatment in top private hospitals or abroad, or people who have that financial bandwidth.

Last updated on: