Health insurance for self-employed people works just like personal (retail) medical insurance. Unlike a corporate health insurance available only through an employer, self employed individuals have to buy their own medical policy to cover hospitalization.

An ideal self-employed health insurance would be ₹10–25 lakh base plan (individual or floater) depending on members, age, and medical history, complemented by a super top-up plan for worse case scenarios. One should prioritise no room-rent limit, shorter waiting periods, unlimited restoration, high bonus, and a strong pan India cashless network.

Introduction

Nearly 60% of India's workforce is self-employed with no boss, no HR, and no fixed hours. But this freedom comes at the cost of missing vital benefits like corporate or group health insurance.

At Ditto, we receive daily enquiries from consultants, small business owners, and freelancers navigating policy limitations, room-rent caps, and exclusions. That’s why we extensively studied the IRDAI guidelines, compared the top health plans, and mapped them to unique customer needs.

The result? A simple, ready-to-refer guide on buying health insurance for the self-employed.

Over the next few minutes, you'll learn:

- What is health insurance for self-employed individuals and its key benefits?

- What are the types of health insurance plans available for self-employed professionals?

- What are the common coverage inclusions and exclusions in a personal health insurance?

- How to pick the right health insurance plan using Ditto's 9-point checklist?

What Is Health Insurance For Self Employed?

Health insurance for self-employed professionals can be either an individual or a family floater plan covering hospitalization and related health expenses. Unlike corporate insurance (with employer subsidies and controlled coverage), you pay 100% of the premium for a personal health plan.

How much health cover do you need?

The ideal health for a self-employed person depends on key factors like age, income, dependents (if any), and existing health risks. Ditto recommends a base plan of ₹10–25 lakh (individual or family floater), along with a super top-up plan for worse case scenarios.

Remember: There’s no category of product called “health insurance for self employed" (neither the insurance companies nor the IRDAI calls it so). It's simply a retail/personal health plan that anyone can buy.

Like a health plan already? We recommend you take a pause, get a second opinion from our expert IRDAI-certified advisors, and make the right purchase. Book your free call with Ditto now!

What Are The Benefits of Health Insurance for Self Employed Professionals?

The benefits of personal health insurance for self employed individuals are many:

- Lifetime coverage during business downturns, career shifts, and breaks, as well as retirement.

- Reduced out-of-pocket expenses during hospitalisation.

- Super top-up advantage when you add ₹20–50 lakh extra cover at low cost (benefits activate after deductibles).

- Tax benefits of up to ₹25,000 (₹50,000 for senior parents) under Section 80D (only under old tax regime)

- Easy insurance portability with retaining of waiting & moratorium period credits.

- Claim assurance as per IRDAI rule for pre-existing conditions that can’t be denied after 5 years of continuous coverage (unless proved fraud).

- Custom cover with a sum insured (₹5L–₹1Cr+), deductible, and riders (maternity, OPD) to suit your family and work needs.

- You can add HospiCash (₹500–₹10,000 a day) during hospital stays for extra income protection.

Note: Unlike base health insurance, hospicash and critical illness riders pay a defined benefit regardless of the actual costs. So, one can use it for meals, transport, or lost wages. Hospicash benefits can be claimed alongside the base insurance with proof of hospitalization and CI riders only require proof of diagnosis.

Quick learn:

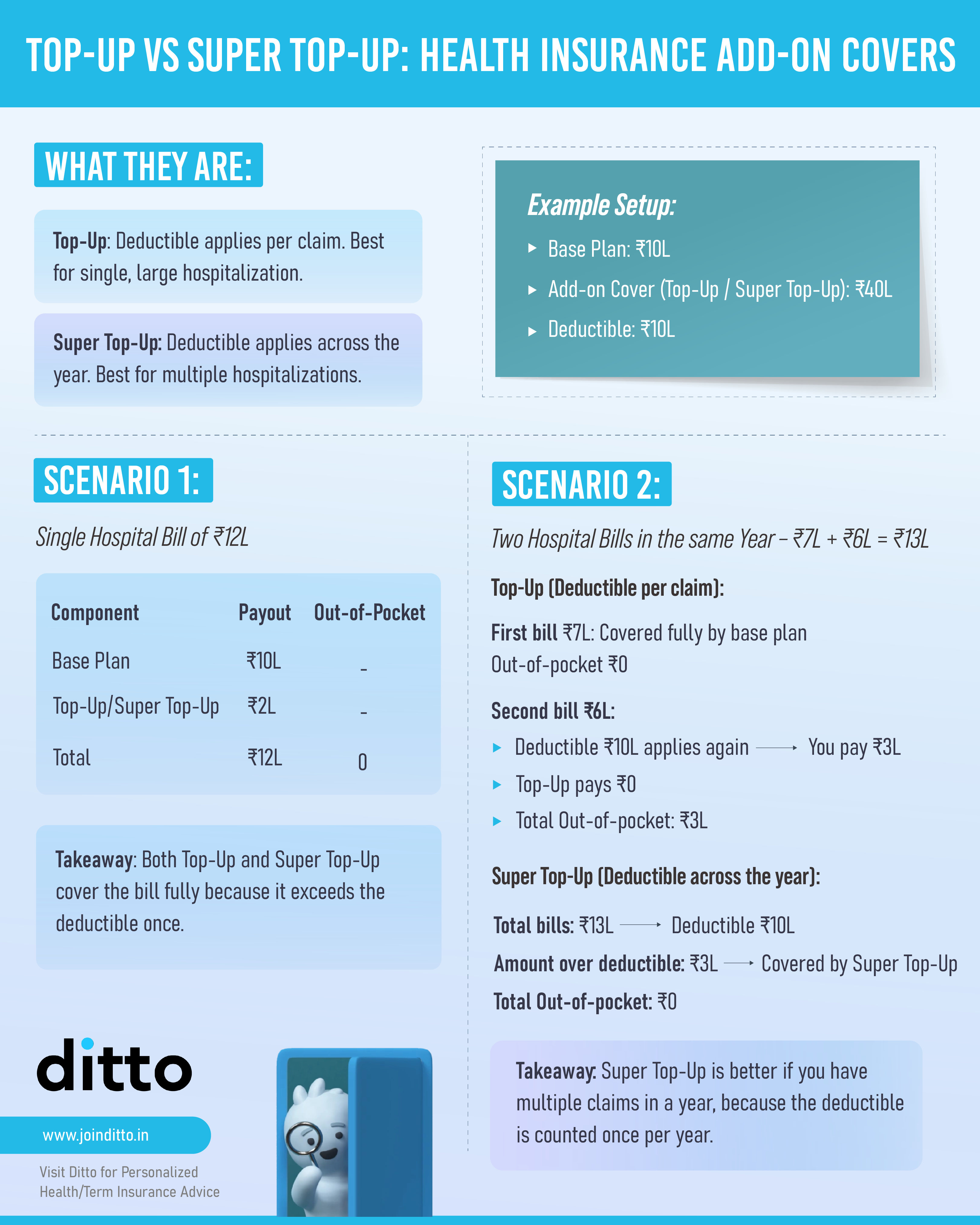

Top-ups & super top-ups are add-on covers that pay once your medical expenses exceed the deductible (the part your base plan covers). With a top-up, you pay the deductible each time you claim. With a super top-up, your medical bills add up for the year (useful for multiple hospitalizations in a year).

What Are The Inclusions And Exclusions Of Health Insurance For Self Employed ?

What your health policy does (inclusions) and doesn’t pay for (exclusions) decides the out-of-pocket expenses. Two health plans with the same sum insured can have different claim benefits, mostly due to room-rent rules, sub-limits, and waiting periods.

Inclusions in health insurance for self employed professionals:

- In-patient hospitalisation: Pays for room, nursing, ICU, OT, and doctor charges after admission (this is the core of your “mediclaim” or health insurance policy)

- Pre- and post-hospitalisation: Tests and consultations usually done 30 days before and 60–90 days after discharge (exact days vary by product). Includes diagnostic tests and recovery meds too.

- Day-care procedures: Relatively short medical procedures, such as dialysis, chemo, cataract surgery, and endoscopy, are covered even without 24-hour admission.

- Ambulance charges: Medically necessary transport to the hospital (often capped per event) is also covered.

- Organ donor expenses: Pays the donor’s hospital expenses related to your transplant (but not for the donor’s follow-up health costs).

- Modern treatments & domiciliary care: Many plans cover robotic surgery, laser procedures, and at-home care with sub-limits.

Exclusions & limits in health insurance for self employed professionals:

- Pre-existing disease (PED) waiting period: Up to 36 months by regulation, while some advanced plans limit it to 12-24 months either by design or via riders. If you mentioned a past health condition when buying insurance, the insurer will pay claims for it only after waiting 3 years. For example, the SBI Super Surplus Platinum Infinite plan, which by design, has a 2- year waiting period for PED. Other plans like Care Supreme, Aditya Birla Activ One Max, HDFC ERGO Optima offer riders a lower PED waiting period to 30 days and even offer coverage from day 1 for specific illnesses for extra premium pay.

- Initial waiting period: 30 days for all illnesses (accidents are covered from day 1). A necessary step to prevent “buy after falling ill” behaviour.

- Specific ailment waiting period: Typically 2 years from the policy purchase date for specific & slow developing ailments such as hernia, cataract, gallbladder stones, etc.

- Room-rent caps & co-pays: If you take a room above your eligibility, the insurer may apply a pro-rata cut to the entire bill—not just the room charge. A co-pay means you pay a fixed percentage of every approved claim, and the insurer pays the rest.

- Consumables/non-payables: Non-payable items in health insurance, such as gloves, syringes, and PPE, are often excluded unless you have a consumables add-on.

- Permanent exclusions: Certain conditions/treatments are never covered if the insurer lists them upfront.

What Are The Types of Health Insurance Plans Available For Self Employed Individuals?

Self-employed professionals can choose from different health plans based on family size, existing risks, budget, and unique coverage needs. Here’s how each plan works and when it's a good fit.

Choosing the right health insurance plan is never easy. Thankfully, we’ve done the heavy lifting for you simplifying IRDAI guidelines and comparing insurers neck to neck for Best Health Insurance Plans of 2025.

Who can buy health insurance for self employed?

Any Indian resident who works and earns independently can buy a personal health plan (unlike a term life insurance plan where insurers ask for ITR, income proof, etc.to check eligibility). The list includes sole proprietors, freelancers, consultants, shop owners, creators, and startup founders, among others.

When buying a health plan, insurers perform risk assessments as per one’s age, health disclosures, past illnesses, and lifestyle diseases (if any). Final approval depends on one’s medical test and risk review by the underwriter. Some cases may have extended waiting periods, exclusions, and even attract higher premiums.

Documents required to buy health insurance

Note: Medical tests are typically required if you’re 45+ or if your disclosures show possible health risks. Your current health standards guide the policy terms (including premium, waiting periods, exclusions).

Estimated annual premiums for different age groups considering comprehensive plans residing in Tier 1 city for a ₹15L SI:

Best Health Insurance Policies for Self-Employed Individuals (2025)

Before we discuss the list, here’s how we decide what plans to feature.

At Ditto, every health plan goes through our six-point evaluation framework. It doesn’t mean these are the only good plans, but that they stand out after being scored across all six pillars.

You can learn more about how we evaluate health insurance plans here.

Smart Tip: Alongside health cover, self-employed earners should evaluate term insurance options for income continuity.

Health Insurance for Self Employed: How To Choose A Good Plan?

Here’s our 10-point checklist to find the right health insurance plan for self-employed individuals. Get predictable billing, cashless access, and a cover you can scale over time.

Choosing a Good Plan: Ditto's Take

Choose plans with no restrictions to avoid unexpected shocks

For example, if your eligible room is for ₹3,000 and you take a ₹6,000 room, most policies will only cover up to 50% of the total bill. So, for a total bill of say ₹2,00,000, you’ll still have to pay ₹1,00,000.

Save a fixed amount monthly just for your health insurance

Premiums usually rise with age and inflation (expect hikes every 2–3 years).

Prepay 2–3 years with a multi-pay/multi-tenure option

Get upfront discounts and protection against near-term premium hikes. Check liquidity and terms and conditions before locking in.

Add a consumables add-on to stay protected against hospitals billing

Non-payable items like gloves, syringes, PPE, etc. generally up to 5-15% of the overall hospital bill, which can add up a lot in a routine surgery.

Go with plans that have shorter PED waiting periods

Most plans have a standard 3-year waiting period for pre-existing diseases, but there are plans that come with shorter (24 months or lower) waiting periods, either by default or through add-ons.

Read the fine print to know specific-ailment waiting periods

Remember, a shorter waiting period means earlier eligibility (this matters if one has a pre-existing medical condition).

Prefer “unconditional restore” with No Claim Bonus

A good NCB (no-claim bonus) ideally shouldn't end with just one hospitalisation.

Cashless coverage is available only at hospitals

lways shortlist health plans that list your preferred hospitals as part of their cashless network. For non-network hospitals, it will always be reimbursement instead of cashless.

Prefer a higher sum insured over a super top-up (if budget allows)

If you still pick a super top-up, disclose full medical history, buy it from the same insurer as your base plan, and set the deductible to either your base plan’s sum insured or an amount you can comfortably pay out-of-pocket in a year.

Do not mix cover as it leads to higher premiums

Get a separate senior-parent policy and keep your core family cover with another.

Why Choose Ditto For Health Insurance?

At Ditto, we’ve helped 7,00,000+ customers become smart insurance buyers by matching their unique needs to the right health insurance policy. That’s why customers like Pramey trust Ditto and recommend us to others.

✅ Honest advice – no sales pitches, no commission-driven recommendations

✅ 12,000+ 5-star reviews (Rated 4.9 on Google)

✅ Real claim experience – we've helped customers through actual claims

✅ Backed by Zerodha and other leading fintech companies

Health Insurance for Self Employed: Final Thoughts

Health insurance is a must-have, especially when you're self-employed. Keep it simple with a ₹5–10L floater for everyday risk, a super top-up to layer it to ₹20–50L, and a critical-illness add-on for rare, expensive treatments.

Additionally, prioritize no room-rent caps, minimal sub-limits, shorter waiting periods, and a strong cashless network. Claim Section 80D tax benefits (only if you opt for the old tax regime), port at renewal, and future-proof your cover with the 5-year moratorium after continuous coverage.

Like a health plan already? We recommend you take a pause, get a second opinion from our expert IRDAI-certified advisors, and make the right purchase. Book your free call with Ditto now!

FAQs:

Which insurance is best for the self-employed?

There’s no single health insurance plan that can be called the “best for self employed”. However, for most a family floater or individual pan of ₹10-15L works best as a starter and another ₹20–50L can be used as a super top-up and add-ons for a balanced protection.

Is critical illness covered under mediclaim, or separate?

While hospital bills are always paid by your core mediclaim (i.e., indemnity), critical-illness is handled separately through a lump sum (paid on diagnosis) only if it's included in the plan via a rider. One can use it to clear their out-of-pocket expenses or protect against loss of income.

Do self-employed plans have waiting periods?

Yes, self employed health insurance plans have an initial waiting period of 30 days. However, for specific ailments, the waiting period is usually up to 2 years. For PEDs, the waiting period can go up 36 months and even more. Some insurers offer add ons to bring down the waiting period for PEDs.

How much does health insurance cost if you’re self-employed?

There is no fixed figure that one pays to buy a health insurance plan for self employed professionals. It varies from insurer to insurer based on age, no of members, sum insured and medical history.

Do self-employed individuals need to take a medical test before buying the plan?

Self employed individuals buying health insurance will have to undergo a medical test only if they are over and above a certain age (for e.g.,45 years). This applies strongly if there’s any pre-existing medical condition and on voluntary disclosure (depends on the insurer where a tele-medical/verification call is made).

Can I buy health insurance while hospitalized?

No! Insurance companies underwrite based on one’s health status during application. Buying a health policy after diagnosis or admission is considered a "moral hazard" and thus your application will be rejected. Insurers will consider your application after 1-3 months of complete recovery and discharge.

Is Arogya Sanjeevani a good health insurance option for me?

Arogya Sanjeevani policy is a basic, affordable health insurance plan offered by the IRDAI to cover hospitalisation costs for individuals and families. While it can be a good starter option, there are some caveats like mandatory 5% payment, no option to add riders and the maximum sum insured goes up to only ₹10 L.

For more flexibility and all round coverage, you will always need a comprehensive health insurance plan- one that not only covers hospitalisation but also other healthcare expenses, treatments, and procedures.

Last updated on: