| Documents Required for Health Insurance Claim: What it Means? Documents Required for Health Insurance Claim refers to the set of essential papers that you need to submit to your insurance provider in order to get your medical expenses reimbursed or settled directly with the hospital. These documents provide proof of hospitalization, treatment, and expenses incurred. They typically include claim forms, hospital bills, discharge summaries, medical reports, prescriptions, government ID proofs, health insurance policy copy, and sometimes FIRs in case of accidents. Providing accurate and complete documents is crucial for a smooth health insurance claim process. |

Documents Required for Health Insurance Claim: Introduction

When a medical emergency strikes, the last thing you want is a delay in your insurance claim because of missing paperwork. Filing a health insurance claim can be straightforward if you know the right documents to submit.

This article covers the essential documents required for health insurance claim, types of claims and their documentation, specific claims documentation, common mistakes to avoid, and also documents needed for group health insurance policy claims.

Still not sure about the documents ? Talk to Ditto’s expert advisors today and get unbiased, personalised guidance - absolutely free.

What Are the Documents Required for Health Insurance Claim?

While the exact requirements differ by insurer and the nature of the claim, most health insurance claims rely on a standard set of documents. These usually include identification and policy details, medical prescriptions, diagnostic reports, hospital bills, and discharge summaries.

Health insurance claims mainly fall into two categories:

- Cashless Claims where the insurance company directly settles the medical bills with the network (partnered) hospital.

- Reimbursement Claims where the policyholder pays the bills upfront and later gets reimbursed by the insurer.

Let’s go through these two individually.

Types of Claims and Required Documents

Documents Required for Cashless Claims

In a cashless claim, the insurance company directly settles the medical bills with the hospital, so the policyholder does not need to make upfront payments (except for non-covered expenses). The documents required for health insurance claim in a cashless treatment include:

- Pre-authorization form/details (issued by the hospital, submitted to insurer/Third Party Administrator).

- Health card / policy copy.

- Government-issued photo ID proof & Age proof (Aadhaar, PAN, Passport, etc.).

- Hospital admission note/card.

- Doctor’s prescription/advice for treatment.

- Diagnostic test reports (lab or imaging, if applicable).

(The insurer coordinates directly with the hospital; original bills stay with the hospital.)

Cashless Claim Specifics

- Cashless claims are only available in the insurer’s network hospitals.

- Pre-authorization ensures the insurer agrees to pay eligible expenses directly to the hospital.

- Certain hospitals or insurers may request original documents or copies for verification.

- For planned treatments, submit a pre-authorization request at least 48-72 hours in advance; for emergencies, within 24 hours of admission. Pre-authorization is generally valid for 15 days, and treatment must match the authorized details.

| IRDAI Guidelines for Cashless Claims Timely submission of documents is key because insurers must follow IRDAI timelines. Pre-authorization for cashless treatment must be processed within one hour, and discharge approvals within three hours. Any delay costs are borne by the insurer. In case of a policyholder’s death, the claim and release of mortal remains must be handled immediately. |

Reimbursement Claim Documentation

For reimbursement claims, the policyholder first pays the hospital bills out of pocket and then submits the claim to the insurance company for repayment. The documents required for health insurance claim in such cases are:

- Duly filled and signed claim form (sometimes also signed by treating doctor).

- Hospital discharge summary/card.

- Original hospital bills and detailed payment receipts.

- Pharmacy/medicine bills with prescriptions.

- Diagnostic test reports (lab & imaging) with receipts.

- Doctor’s prescription/advice for hospitalization.

- Indoor case papers/nursing sheets (if requested).

- Implant invoices & stickers (lens in cataract, stent in angioplasty, etc.).

- Government-issued photo ID & age proof of insured.

- Health card / policy copy.

- Medico-legal case (MLC) or FIR copy in accident cases.

Note: All originals are usually required. Documents must be submitted within the timelines defined in your policy, typically 30 days from discharge.

| Disclaimer: This is not an exhaustive list of documents. Document requirements may vary across insurers, policies, and specific claim situations. Please read your insurer’s policy wording and claims handbook carefully to confirm the exact documentation applicable to your policy. Different scenarios such as overseas, accident-related, homecare treatment, maternity, vaccination, ambulance usage, or high-value claims (requiring KYC/NEFT details) may involve additional documentation. Always check with your insurer or TPA (Third Party Administrator) before submission to avoid delays or rejection. Additional Notes: 1) Bills/invoices must be in the insured’s name. 2) If originals already submitted to another insurer, certified copies with claim settlement advice are accepted. 3) Insurers may request medical examinations at its own cost. 4) Delayed submissions may be condoned if delay was beyond insured’s control. |

Explore the key differences between cashless and reimbursement health insurance claims here.

Documents Required for Different Types of Hospitalization

The documents required for health insurance claim also vary depending on the nature of hospitalization. Insurers often ask for additional or specific paperwork to validate the treatment and ensure accurate claim processing.

Emergency Hospitalization Claims

- In cases of accidents or sudden illnesses, inform the insurer ideally within 24 hours of admission to enable smooth cashless processing.

- Submit the hospital’s emergency admission certificate or ER report to validate urgent care.

- If the hospitalization involves an accident or potential legal issues, provide a police FIR or medico-legal case report.

- As per IRDAI guidelines, insurers cannot deny coverage for genuine emergency hospitalizations, and accident-related claims must be supported by legal documents for verification and transparency.

Planned Hospitalization Claims

- A pre-authorization request form must be submitted for insurer approval prior to planned treatments, as per IRDAI rules, which ensure that planned hospitalizations are pre-approved for faster claim processing.

- Appointment letters or medical advice confirm the necessity and schedule of planned treatment. To comply with IRDAI rules and avoid claim issues, notify the hospital and initiate the cashless claim 48-72 hours before admission.

Pre and Post-Hospitalization Claims

- Medical bills and prescriptions for ongoing before admission and post-discharge care and medicines must be submitted to claim expenses occurring after hospitalization.

- As per IRDAI guidelines, which cover pre- and post-hospitalization for a set number of days, follow-up reports and test results help substantiate ongoing care.

- For reimbursement claims, all pre-hospitalization and post-hospitalization documents should be submitted within 15–30 days of completing the respective treatment period to ensure timely processing.

Documents Required for Group Health Insurance Claim

Submitting the necessary documents required for health insurance claim ensures a smooth and timely settlement under a group policy. The key documents include:

- Duly filled and signed claim form (the group health insurance claim form has two parts: Part A is filled and signed by the employee, while Part B is completed and signed by the hospital).

- Hospitalization bills (all original bills or invoices from the hospital, pharmacy, or any other medical services must be submitted).

- Medical reports (include all pathological, diagnostic, and consultation reports from doctors or specialists).

- Final payment invoice (the hospital’s final invoice should show a detailed breakdown of expenses such as consultation fees, procedure charges, tools or equipment used, and diagnostic report fees).

- Health card (carry the original health card, either in physical form or as an e-card, for verification).

- Government ID proof (a photocopy of an official ID with a photograph, such as aadhaar, pan, or passport).

- Dates of admission and discharge (clearly mention the hospital admission and discharge dates to verify the duration of treatment).

Also check out the essential documents required for buying a health insurance policy and the submission process here.

Common Mistakes to Avoid While Submitting Documents

When submitting the documents required for health insurance claim, policyholders should avoid these common errors:

- Submitting incomplete or unsigned claim forms.

- Missing original bills and receipts or submitting photocopies without insurer approval.

- Delayed submission beyond the claim intimation or submission period.

- Failing to provide relevant medical reports, prescriptions, or discharge summaries.

- Not retaining copies of submitted documents for future reference.

- Ignoring insurer-specific formats or required declarations for certain procedures (e.g., pre-authorization forms for cashless surgeries, maternity claim declarations, or hospital checklists for day-care procedures).

- Providing inconsistent or mismatched details (like patient name, policy number, or hospital details) across documents.

- Overlooking IRDAI-mandated documents, such as FIRs for accident claims or pre-authorization forms for cashless treatment (these are required by regulations to verify emergencies, accidents, or prior approval for hospital procedures).

For a complete guide on how to claim your health insurance, step-by-step procedures, and tips to avoid delays, read this guide. It will give you a clear understanding of the entire claim process, timelines for submission, and best practices to ensure faster and hassle-free settlement.

Why Consider Ditto for Health Insurance?

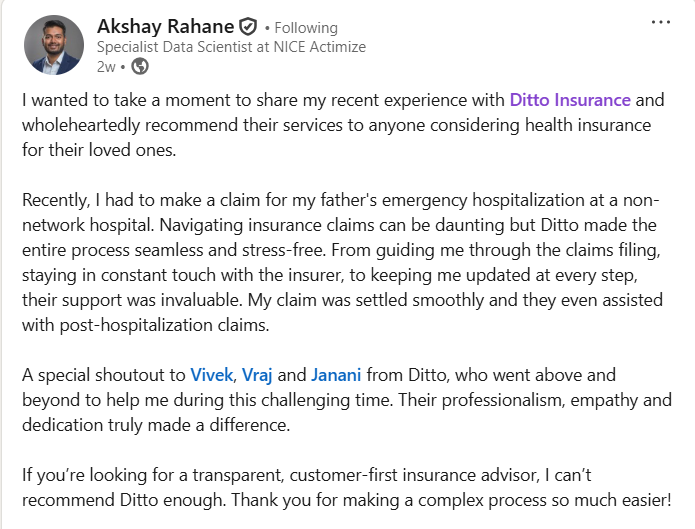

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right health insurance policy. Here’s why customers like Akshay love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

Submitting the right documents required for health insurance claim is critical for smooth and timely approval. Whether it is a cashless or reimbursement claim, organize all required papers carefully and avoid common mistakes to save time and hassle during claim processing.

At Ditto, we help you manage your health insurance claims efficiently, providing expert guidance to avoid documentation errors and ensure faster settlement. If you need any help or any understanding regarding claim processes, feel free to book a call with our experts to get personalized support.

FAQs

What happens if I miss submitting a required document for my claim?

Missing documents can delay or reject your claim. It’s important to submit all mandatory papers promptly to avoid claim processing issues.

Do I need to submit original bills for a health insurance claim?

Yes, most insurers require original bills and receipts, especially for reimbursement claims. Photocopies may be accepted only if specifically allowed by the insurer.

How soon should I submit my health insurance claim documents after discharge?

Generally, documents should be submitted within 15 to 30 days of discharge or as specified in your policy terms.

Last updated on: