Understand Your Health Insurance Policy

Understand what your policy has to offer. Read terms and conditions in plain English. And discover the good, the bad, and the lacking features in your health plan.

What is a health insurance policy?

A Health insurance policy is a contract underscored by one key arrangement – You pay a sum every year or every 2 years or every 3 years, depending on how you structure the policy and you get the insurance company to pay for all medical expenses you incur when you're eventually hospitalized.

The sum you pay every year is called the premium. And the protection you receive in return is characterized by the total cover or the Sum Insured. So the first question you consider when buying a health insurance policy is this –

A Quick Word: Did you know that going through insurance policy wordings means simultaneously scanning a financial, medical, and legal document? And well, that sounds taxing!

Here's what we suggest — leave that part to us! with us and get solid insurance advice from IRDAI-certified advisors! No spam, no cold calls - just a conversation for your customised policy!

Limited slots! Book today!

What kind of cover should I need? Or in other words what is the ideal Sum Insured?

Well, that depends on a few things. But in general, a cover of anywhere between ₹10–20 lakhs is a good option to consider. If you go under ₹10 lakhs, say ₹2–3 lakhs, then you run the risk of short-changing yourself.

Sure, ₹2–3 lakhs isn't a modest sum by any account. But it isn't a life-changing sum either. If you're ever hospitalized for an ailment, you will likely be able to put together this kind of money without an insurer. It won't be pleasant and it most certainly won't be easy. But it's something that you can hope to cobble together if you really need the cash.

What will cripple you however is the bone marrow transplant that costs ₹20 lakhs. Or the recurring cancer treatment that can push you to the brink of financial ruin. And the ₹2–3 lakh figure simply won't cut it. Also, medical costs keep rising disproportionately each year. In fact, medical inflation is routinely pegged at 10+%. So if you buy a ₹5 lakh plan today, it may only be worth ₹2.5 lakhs in a few years because inflation is making everything more expensive.

So starting off at ₹1–5 lakhs may not be the most prudent option. Unless you simply don't have the provision to set aside more money. In which case some cover is better than no cover.

Alright, but if ₹1–5 lakh isn't an option, where are we drawing the line then? Should we go ₹50 lakhs? or ₹1 crore? What's the top limit?

Well in our experience, even the more expensive treatments hardly ever breach the ₹20 lakh mark. You'd have to really struggle to find a comprehensive list of treatments that will cost you more. Also in most cases, health insurance policies offer you significantly higher protection than you may have imagined. For instance, with a comprehensive policy, you could get a base cover of say ₹10 lakhs, a no-claim bonus that could add another ₹10 lakhs in a couple of years, and a restoration benefit that would offer you an additional ₹10 lakhs worth of protection. All in all, you'd be covering for most exigencies by picking a cover anywhere between ₹10–20 lakhs without spending a fortune.

Talk to an expert today and

find the right insurance

for you.

How to buy a health insurance policy?

Before buying a health insurance policy, you need to consider a few key things.

First, pick the right insurer.

- A good insurer should have a robust claim settlement ratio, any figure greater than 90% is stellar.

- A good insurance company should have a large network of partner hospitals. Preferably 7000+.

- A good insurer should have an extensive track record. Anything greater than 5 years is a pretty decent number.

- A good insurer should also host an extensive product portfolio. Products that cover use cases with maternity benefits, outpatient consultations, senior citizens, heart patients, etc.

- A good insurer should also be proactive in dealing with customer queries. In this regard, we generally find private insurance companies do better than public insurers.

Best Health Insurance Companies in India

Note that this isn't an all-encompassing list. Instead, it's expected to offer you some guidance.

Checklist of essential features in a good health insurance policy

- A good policy should have no room rent restrictions.

- It will not impose a co-payment clause.

- It should offer a no-claim bonus of atleast 50%.

- A good policy should extend a restoration benefit of atleast 100%.

- A good policy must have short waiting periods for pre-existing conditions.

- A good policy should offer pre and post-hospitalization care. Preferably 60 days before hospitalization and 90 days post hospitalization.

- It should also cover daycare treatments.

- A good policy should also offer a free health checkup every year.

Also, we have a dedicated page for Health Insurance checklist here. You can read about it in some more detail.

Once we have a checklist for insurers and the policies themselves we can make a list that includes the best health insurance policies for 2025.

However, do note that the article so far describes how to pick a health insurance policy for generic cases. But if you're reading this, you probably have a very specific use case. You could be looking to buy health insurance for a family. You could be a married couple looking to cover your newborn. You could be somebody looking to buy a policy at a bargain price. And in each case, there will be subtle differences in how you ought to approach health insurance.

So let's start with the most popular use case - Families.

How do you pick a health insurance policy for families?

The short answer is to pick a family floater plan.

The long answer is a bit more complicated. You see, a family floater policy is designed to cover you and your family under a single umbrella contract. You can include yourself and your dependents under the same plan and pay a single premium for combined coverage. However, most insurance providers have a rather narrow definition of what dependents actually mean. And they only let you include your spouse and kids alongside yourself when buying a family floater option. If you have parents and siblings, who you also intend to cover, you may not be able to do so under a family floater plan. But despite this restriction, it is an efficient and economical option if you're looking to cover multiple members in your family and here's why

Talk to an expert

today and

find

the right

insurance for you.

Benefits of a family floater option

- It's operationally less intensive - As opposed to buying and maintaining multiple policies for each individual, you can have a single policy that accounts for your entire family

- It's relatively inexpensive - If you're picking an individual plan for each member of your family, then the premiums could be prohibitive. However, if you're including them in a single plan, your premiums will be substantially lower

- If you plan to insure your kids under the age of 18, you may not have many options besides including them in a family floater plan

- It generally extends all the benefits that individual health policies extend.

- Insurers generally extend a family floater option with most policies they market

Frequently looked policies for families:

How to buy health insurance if you're a couple planning for kids?

If you're a couple planning for kids, you probably have your eyes set on childbirth. Unfortunately, maternity procedures are expensive. A normal delivery in a private hospital in Bangalore will cost you upwards of ₹50,000. A C-section will probably be much more expensive — ₹75,000 or more. If you're in a more expensive facility then it will set you back a lakh or so. However if you're planning to buy insurance, just to cover these costs, then you should know a few things.

First, insurers will increase your premiums considerably when you buy a plan with maternity benefits. A regular plan might cost you ₹9,000. But a plan with maternity will cost you ₹11,000 or more. Next, they'll mandate something else. They'll tell you that you can only buy a maternity plan if you have your spouse included in it as well. At this point, you have to remember that one of you is paying for the maternity benefit even though you won't ever be making a claim yourself. Men don't give birth to children and as such, the insurer is getting you to pay for something they know isn't applicable to both of you. And finally, they'll tell you that you can only make a maternity claim after 3 years of holding the policy, give or take. And they'll also place sub-limits — ₹30,000 for normal childbirth and ₹50,000 for a C-section. So it's entirely possible that you may pay more in premiums during a policy term compared to the actual costs associated with childbirth.

However, that doesn't mean there is absolutely no utility here either. For instance, if your newborn has complications that require urgent medical attention, you'd be well served to have a plan that covers maternity expenses, since most plans cover your newborn with Day 1.

Best Health Insurance Plan For Expecting Couples (Maternity Insurance Plans)Frequently looked policies for couples planning a kid:

How to buy a health insurance policy if you're a salaried individual?

If you're a salaried individual, you likely have a corporate health insurance policy. However, bear in mind that corporate health insurance policies come with their own caveats. For one, your employer may not be particularly inclined to extend a plan with extensive benefits. And they routinely impose restrictions on these plans. The most popular restrictions include restrictions on room rent. So if you want to upgrade your room when you're being treated for an illness, you may have to pay extra. Then there's the fact that corporate health insurance plans only cover your expenses when you're employed with the same company. If you quit, you will also have to let go of the benefits associated with the plan.

Meaning, all things considered, it makes sense to have a separate health insurance policy that doesn't impose these restrictions. What plans should a salaried individual consider you ask?

Individual Health Insurance Plans for Corporate EmployeesFrequently looked policies for people with Diabetes:

Frequently looked policies for parents who are about to retire:

Talk to an expert today and

find the right insurance

for you.

How to make a claim if you have a health insurance policy?

- In the case of emergency hospitalization, you have to intimate the insurer or make the claim as soon as you get the patient admitted. In the event that isn't possible, you must intimate the insurer within 48 hours of hospitalization.

- In the case of planned treatment, you have to intimate the insurer 3 days before admission. But if you can do it sooner, you should probably consider doing that as insurance companies may take a while to investigate the veracity of your request.

- Check for partnered hospitals — Each insurer will have a dedicated network of hospitals they'll have partnered with. Once you find a partner hospital of your liking, you can try to make the claim on a cashless basis. That is to say that the hospital will directly communicate with the insurer and bill them without asking you to pay anything out of pocket

- If you try to make a cashless claim, you will have to fill a Pre-Authorization Request Form.

- The form will be made available to you once you intimate the insurer that you will be making a cashless claim. You'll have to fill in your personal details and the hospital will fill out the rest. Once complete, you can ask the hospital to submit this form back to the insurer.

- Upon receipt of this form, the insurer will validate your claim and approve a sum that will be paid out on a fully cashless basis. In the event the treatment costs exceed this sum, then you'll have to pay the difference and seek reimbursement once you're discharged.

- If you don't find a network hospital of your liking or if the cashless claim doesn't pass, then you may have to file for reimbursement — wherein you pay the full cost of treatment and ask the insurer to reimburse you afterwards

How to file for reimbursement?

- Oftentimes insurance companies may be tentative to settle a claim on a cashless basis but will gladly do so once you've paid the bill in full. This process is called reimbursement.

- To file a claim, you will need to download the claim form from the insurer's website. Some insurers will also have an online portal for submission.

- The claim form is divided into two parts — Part A & Part B. You'll have to fill out Part A and the hospital personnel will fill out part B. They'll also have to sign and seal the document.

- In the meantime, you have to collect and collate all the investigation and medical reports associated with your prognosis.

- And finally, you will have to mail the original reports to the insurance company and wait for them to process your claim.

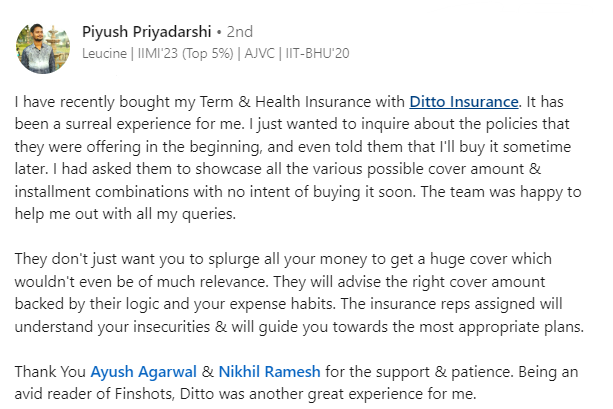

Why Talk to Ditto for Your Health Insurance?

At Ditto, we've assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Piyush below love us:

No-Spam & No Salesmen

Rated 4.9/5 on Google Reviews by 10,000+ happy customers

Backed by Zerodha

100% Free Consultation

You can with our team. Slots are running out, so make sure you book a call now!

What documents do you need while making a claim with a family floater plan?

- Investigation and Medical reports: You will need investigation reports signed by your physician and approved by the hospital.

- Discharge Summary: A discharge summary will include further details about your diagnosis, treatments extended and the protocols followed to effectively treat your condition. The discharge summary must be printed on hospital letterhead and include all relevant data, such as the hospital's address, license number, and contact specifics.

- The final bill: An itemized bill that includes expenses incurred across the board. It must have specific breakdowns, detailed statements and also include consultation charges.

- Invoice details: Medical implants and other consumables must be supported by the invoice associated with the products.

Frequently asked questions

Talk to an expert

today and

find

the right

insurance for you.