- Introduction

- Comparing Insurers

- Track Record

- Claim Settlement Ratio

- Amount Settlement Ratio

- Scale of Business

- Operational efficiency

- Comparing Policy Features

- Critical Illness Benefit

- Zero Cost Option

- Accidental Death Benefit

- Terminal Illness Benefit

- Top-Up cover

- Waiver of Premium

- Increasing cover

- Frequently Compared Policies

Introduction

Comparing term policies is relatively straightforward considering the fact that most term policies serve a very simple function. They make a large payout to your family (nominees) in your absence. So ideally you should pick a term insurance policy from an insurer that is most likely to pay out a claim.

How do you do this?

Company comparison

Well, you first whip up a company-specific evaluation. Ignore the policy and just compare the two insurers, their settlement ratios, track record & volume of business. If at any point you find that an insurer is deficient in this department, then it's time to drop them. You can't pick them over a company that is most likely to pay out your claim.

Policy comparison

However, having said that oftentimes, you may have very specific requirements when buying a term policy. For instance, some people may also want designated payouts if they were ever diagnosed with some critical illness (say: cancer). In which case, you also have to look at the term policy and see if it extends meaningful features beyond the "death benefit". So you also look at the "add-ons" they offer. This comes in handy when you are picking two very good insurers and can't choose between them. Simply pick a policy with the most flexibility or add-ons.

And one final thing you also have to consider is the price. If you like a policy but you can't afford it, then it's time to reconsider. Pick a policy that you know is in your budget because the last thing you want to do is buy a policy and then not afford the premiums two years later. Your money goes to waste then.

With the introduction out of the way we can now look at each factor in greater detail.

Comparing Insurers - How do you decide which insurance company is better?

Track Record

The first thing you do is try and see which insurance company has a better track record. For instance, buying a term insurance policy from a newly established company, say a year old, is a gamble you do not want to be taking with your life. You can't meaningfully assess their performance since you never know how things might shape up in the future. Maybe their claim settlement ratios were very good last year but it could all go sour the very next year. In contrast, a company with a more extensive track record allows for a more robust evaluation of its consistency and performance over the years.

But what is a good track record?

The Indian insurance sector opened up to private entities in 2000, thus, most private insurance companies have a track record of less than 23 years. However, a company with a track record of 10 years or more is often considered reliable. A track record of 5 years and above is viewed as decent, while we generally advise steering clear of companies with a track record of less than 5 years.

| Company | When did it start? | Primary investors of the company |

|---|---|---|

| LIC | 1956 | Government of India |

| HDFC Life | 2000 | HDFC Ltd and Abrdn |

| ICICI Prudential Life | 2000 | ICICI Bank and Prudential PLC |

| Aditya Birla Sun Life | Founded in 2000 and operations began from 2001 | Aditya Birla Capital and Sun Life Financial Inc. of Canada |

| Axis Max Life | Founded in 2000 and operations began from 2001 | Max Financial services and Axis Bank |

| SBI Life | Founded in 2000 and operations began from 2001 | State Bank of India and BNP Paribas Cardif |

| TATA AIA | 2001 | Tata Sons Pvt. Ltd. and AIA life |

| Kotak | 2001 | Kotak Mahindra Bank |

| Bajaj Allainz | 2001 | Bajaj Finserv Ltd. and Allianz SE |

| PNB Metlife | 2001 | Punjab National Bank, MetLife International Holdings Inc. |

| Reliance Nippon Life | 2001 | Reliance Capital and Nippon Life Insurance |

| Exide Life | 2001 | Exide Industries Limited |

| Aviva Life | 2002 | Aviva plc and Dabur group |

| Shriram Life | 2005 | Shriram Capital and Sanlam |

| Bharti AXA Life | 2006 | Bharti Enterprises and AXA |

| Star Union Dai-ichi Life | 2007 | Bank of India, Union Bank of India, and Dai-ichi Life |

| Future Generali India Life | 2007 | Future Group and Generali Group |

| Ageas Federal Life | 2007 | Ageas, Federal Bank, and IDBI Bank (Later IDBI Bank reduced its stake) |

| Aegon Life | 2008 | Aegon NV and The Times group |

| Canara HSBC Life | 2008 | Canara Bank, HSBC Insurance (Asia Pacific) Holdings Limited, and Oriental Bank of Commerce |

| Pramerica Life | 2008 | Prudential International Insurance Holdings and DLF Limited (Later DLF sold its stake) |

| IndiaFirst Life | 2009 | Bank of Baroda, Union Bank of India, and Carmel Point Investments India Private Limited |

| Edelweiss Tokio Life | 2011 | Edelweiss Financial Services and Tokio Marine Holdings |

Talk to an expert

today and

find

the right

insurance for you.

Claim Settlement Ratio

Claim settlement ratio tells you about the percentage of claims settled by an insurer during a specified period. Put another way, a claim settlement ratio of 99 tells you that the insurance company settled 99 claims for every 100 claims they booked during the year.

This is perhaps the most important number you have to look at since with a term policy you want your claim paid out without any issue.

The figure is calculated using the formula: Claims settled / (Claims booked + Claims outstanding at the beginning - Claims outstanding at the end)

| Company | CLAIM SETTLEMENT RATIO (avg. of last 3 years) |

|---|---|

| Axis Max Life Insurance Co. Ltd. | 99.5% |

| Aegon Life Insurance Co. Ltd. | 99.35% |

| HDFC Life Insurance Co. Ltd. | 99.2% |

| Bajaj Allianz Life Insurance Co. Ltd. | 99.11% |

| Bharti AXA Life Insurance Co. Ltd. | 99.07% |

| Canara HSBC Life Insurance Co. Ltd. | 98.95% |

| TATA AIA Life Insurance Co. Ltd. | 98.91% |

| Edelweiss Tokio Life Insurance Co. Ltd. | 98.84% |

| Pramerica Life Insurance Co. Ltd. | 98.76% |

| Reliance Nippon Life Insurance Co. Ltd. | 98.73% |

| Aviva Life Insurance Co. Ltd. | 98.71% |

| Kotak Mahindra Life Insurance Co. Ltd. | 98.59% |

| Life Insurance Corporation of India | 98.55% |

| PNB MetLife India Insurance Co. Ltd. | 98.54% |

| Aditya Birla Sun Life Insurance Co. Ltd. | 98.23% |

| ICICI Prudential Life Insurance Co. Ltd. | 97.52% |

| IndiaFirst Life Insurance Co. Ltd. | 97.5% |

| Star Union Dai-ichi Life Insurance Co. Ltd. | 96.54% |

| Ageas Federal Life Insurance Co. Ltd. | 96.32% |

| SBI Life Insurance Co. Ltd. | 95.8% |

| Future Generali India Life Insurance Co. Ltd. | 95.51% |

| Shriram Life Insurance Co. Ltd. | 91.68% |

In our opinion, a claim settlement ratio of 99% and above is stellar. A claim settlement ratio of 98-99% is decent. And anything less than that is a no-go. Now you may think these numbers are relatively high. But that's how it should be with a term policy. Death is final. There shouldn't be a lot of debate on whether a company needs to settle a claim. In fact. IRDAI rules clearly state that no claim will be called to question if you've held the policy for 3 years or more. So a higher number is a requirement here.

You can find the claim settlement ratios in our comparison tables. Or you could go check out IRDAI's annual report for the stated figures.

Claim settlement ratios do a very good job of representing the overall claim settlement process. But they still leave out some very important details. For instance, imagine a situation when a company pays out 99 claims after booking 100 claims in any given year. You would like to think that they settle almost every claim. But what if the 99 claims they settled were all worth 1 crore each whereas the one claim they rejected amounted to 10 crores? This is one way companies could manipulate their claim settlement numbers. Settle all the lower-value claims while denying the more expensive claims.

So to get rid of the bias, you can compare the amount settlement ratios for 2 companies. Simply look at the total amount settled as a percentage of the total value claimed by people. This should give you a good idea of who's doing better.

| Company | AMOUNT SETTLEMENT RATIO (avg. of last 3 years) |

|---|---|

| Aegon Life Insurance Co. Ltd. | 97% |

| Bajaj Allianz Life Insurance Co. Ltd. | 96.9% |

| Aviva Life Insurance Co. Ltd. | 96.5% |

| Pramerica Life Insurance Co. Ltd. | 96.5% |

| Axis Max Life Insurance Co. Ltd. | 95.5% |

| Life Insurance Corporation of India | 95.1% |

| Reliance Nippon Life Insurance Co. Ltd. | 94.8% |

| Aditya Birla Sun Life Insurance Co. Ltd. | 93.9% |

| Canara HSBC Life Insurance Co. Ltd. | 93.8% |

| Kotak Mahindra Life Insurance Co. Ltd. | 93.1% |

| Bajaj Allianz Life Insurance Co. Ltd. | 93% |

| Star Union Dai-ichi Life Insurance Co. Ltd. | 93% |

| TATA AIA Life Insurance Co. Ltd. | 92.7% |

| Exide Life Insurance Co. Ltd. | 92.5% |

| ICICI Prudential Life Insurance Co. Ltd. | 92.1% |

| PNB MetLife India Insurance Co. Ltd. | 91.5% |

| IndiaFirst Life Insurance Co. Ltd. | 90.4% |

| SBI Life Insurance Co. Ltd. | 90.2% |

| Future Generali India Life Insurance Co. Ltd. | 88.6% |

| HDFC Life Insurance Co. Ltd. | 87.3% |

| Ageas Federal Life Insurance Co. Ltd. | 87.3% |

| Edelweiss Tokio Life Insurance Co. Ltd. | 83.2% |

| Shriram Life Insurance Co. Ltd. | 54.4% |

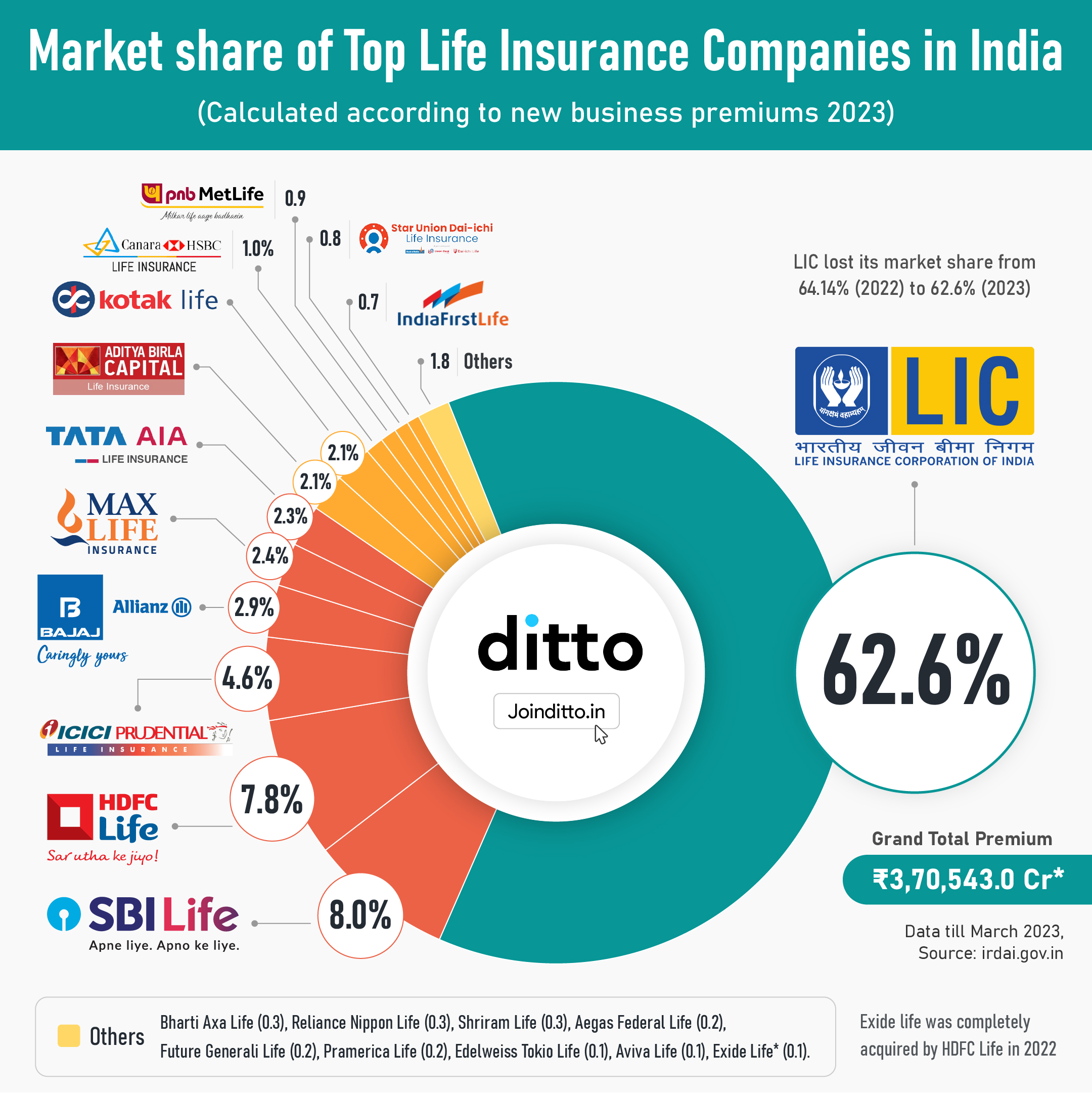

Scale of Business

It's very easy to put up very good claim settlement numbers when you are settling a few hundred claims and dealing with a few thousand policyholders. But can you put up the same performance when you are selling tens of thousands of policies and dealing with similar volume of claims? Well, that's what we want to try and answer when we look at the scale of business.

If a company has massive scale and they still put up impressive numbers, then that's a massive positive. However, if a company is relatively smaller in scale, then maybe you should reconsider its figures. You can calculate the scale of business by looking at the new premiums they generated in the last few years.

Operational Efficiency and Total Complaints Received (per 10,000 claims registered)

The last thing you probably have to check for is operational efficiency. How well do insurers deal with application errors? How do they deal with the paperwork? Are they receptive to customer complaints? Are they responsive when you raise a ticket?

It's not immediately obvious if a particular insurer is robust in this department. However, there are a few ground rules you could follow. You would be well advised to steer clear of public insurers. In our experience, government-owned insurance companies have a pretty poor track record when it comes to being receptive to customer complaints, especially when you are filling out the application and forwarding your term insurance proposal. It's not to say that private insurers are far better, but they do perform relatively well when compared to their state-owned counterparts.

But even amongst private insurers, you have some who are more in tune with their customers and others who don't care as much. Once again, it's not easy to tell them apart. But you could scour the web for some data points. One point of information is customer complaints.

How many complaints did a term insurance provider receive for every 1000 claims they booked? This gives you a good idea of who is customer friendly and who isn't.

| Company | COMPLAINTS (per 10,000 claims) |

|---|---|

| HDFC Life Insurance Co. Ltd. | 2 |

| TATA AIA Life Insurance Co. Ltd. | 3 |

| Reliance Nippon Life Insurance Co. Ltd. | 3.2 |

| Aditya Birla Sun Life Insurance Co. Ltd. | 3.7 |

| Bajaj Allianz Life Insurance Co. Ltd. | 4.4 |

| SBI Life Insurance Co. Ltd. | 4.8 |

| Kotak Mahindra Life Insurance Co. Ltd. | 6.7 |

| Life Insurance Corporation of India | 7.3 |

| Axis Max Life Insurance Co. Ltd. | 7.3 |

| Shriram Life Insurance Co. Ltd. | 13 |

| ICICI Prudential Life Insurance Co. Ltd. | 14.3 |

| Star Union Dai-ichi Life Insurance Co. Ltd. | 15.7 |

| Canara HSBC Life Insurance Co. Ltd. | 23.7 |

| Aegon Life Insurance Co. Ltd. | 45.3 |

| IndiaFirst Life Insurance Co. Ltd. | 48 |

| PNB MetLife India Insurance Co. Ltd. | 55 |

| Pramerica Life Insurance Co. Ltd. | 55.7 |

| Bharti AXA Life Insurance Co. Ltd. | 137.7 |

| Aviva Life Insurance Co. Ltd. | 149.3 |

| Edelweiss Tokio Life Insurance Co. Ltd. | 190.7 |

| Future Generali India Life Insurance Co. Ltd. | 307.3 |

| Ageas Federal Life Insurance Co. Ltd. | 485 |

Once you are done with this, you can now look at the policy itself and the features they extend.

Talk to an expert

today and

find

the right

insurance for you.

Comparing policy features - How to decide which term insurance policy has the better add ons

Outside of "death benefit" one of the most important features you'd want in a good term insurance policy is a critical illness benefit i.e. if you're ever diagnosed with a debilitating illness, you would want your insurance policy to pay a fixed sum so that you can deal with any monetary obligations you may have. Ideally you want to have a policy that offers coverage for at least 32 diseases and you want to make sure that it covers all the high-risk, high-probability events - heart failure, cancer etc.

You also want to make sure that the payout is subject to few conditions. If there are several conditions included, then may be you should opt for a policy that comes with fewer strings attached.

Some insurers will return all your premiums if you forego your policy before maturity, during a period specified by the insurer. So in essence, you get all your premiums back, while also being protected under the term plan during this time. So any policy that extends a zero cost option could be a viable option for you.

It's also nice to have an option to add extra protection for accidental deaths. And while we recommend customers choose a comprehensive cover without worrying about the specifics of death precisely, if you're somebody who travels frequently or works in accident-prone areas, this is definitely something useful.

Some policies will disburse the entire cover amount the moment you are diagnosed with a terminal illness. So even in the absence of death, you can still get the money and use it any way you wish. If a policy offers a terminal illness benefit, it should definitely get some extra points.

Top-Up cover

Once you buy a term policy, you seldom have the provision to increase your cover amount. In fact, the only way you can increase your cover amount is by buying a new policy. This can be very irritating to most people. So any time an insurance policy gives you the option of topping up your cover at a future date, you have to be pleased.

If you are ever disabled or diagnosed with a critical illness, the last thing you want to do is keep paying your premiums. And so it's always nice when a term insurance provider tells you that they will waive off all future premiums if you were ever in this position. Meaning any policy that extends this benefit should definitely be something you could consider.

Increasing cover with inflation

Some policies automatically increase your cover by a certain amount (usually inflation) to always provide you with the necessary protection. So that's something you should look out for as well.

Finally, you have to bear in mind, that there is no such thing as "one size fits all". Ultimately everybody has different needs and budgets. So while we may recommend one policy over another based on what we feel is important. Maybe you won't agree with that assessment.

Maybe you'll have different expectations. So our comparison tool is only expected to act as a guide in helping you better understand two policies. It should never serve as a replacement for your own good judgement.

If you still have questions on how to compare two term insurance policies you can reach out to our IRDAI certified advisors .

Talk to an expert

today and

find

the right

insurance for you.